Scheduled Maintenance: We need to purge all sessions. You will need to login again.

Business/Markets/Stocks/Economics Random, Random

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Trump’s Trade War Escalates as China Retaliates With 34% Tariffs

The Chinese government said it would match President Trump’s tariff, and also barred a group of American companies from doing business in China.

By Keith Bradsher and David Pierson

Keith Bradsher reported from Beijing and David Pierson from Hong Kong.

April 4, 2025

Updated 10:25 a.m. ET

China has struck back at President Trump.

On Friday evening in Beijing, in a rapid-fire series of policy announcements including 34 percent across-the-board tariffs, China showed that it has no intention of backing down in the trade war that Mr. Trump began this week with his own steep tariffs on imports from around the world.

China’s Finance Ministry said it will match Mr. Trump’s plan for 34 percent tariffs on goods from China with its own 34 percent tariff on imports from the United States.

Separately, China’s Ministry of Commerce said it was adding 11 American companies to its list of “unreliable entities,” essentially barring them from doing business in China or with Chinese companies. The ministry imposed a licensing system to restrict exports of seven rare earth elements that are mined and processed almost exclusively in China and are used in everything from electric cars to smart bombs.

The commerce ministry also announced it was beginning two trade investigations into American exports of medical imaging equipment — one of the few manufacturing categories in which the United States remains internationally competitive.

China’s General Administration of Customs said that it would halt chicken imports from five of America’s biggest exporters of agricultural commodities and sorghum imports from a sixth company.

And China’s State Administration for Market Regulation announced that it suspected the China division of DuPont, the American chemicals giant, had violated China’s antimonopoly law and would investigate. DuPont had said in a statement that it took the matter very seriously and was reviewing China’s claims.

China’s new 34 percent tariffs, which are in addition to previously imposed tariffs, will hit fewer goods than President Trump’s tariffs only because China sells far more to the United States than it buys. China bought $147.8 billion worth of American semiconductors, fossil fuels, agricultural goods and other products last year. It sold $426.9 billion worth of smartphones, furniture, toys and many other products to the United States.

China is America’s second-largest source of imports, after Mexico, and third-largest export market, after Canada and Mexico.

But while President Trump’s tariffs exempted some large categories of imports, like semiconductors and pharmaceuticals, the Chinese tariffs have no exemptions.

Beijing’s actions triggered a sharp decline in futures markets for American shares, and on Friday, the S&P 500 opened 2.5 percent lower after posting on Thursday its worst single-day result since 2020.

China’s Finance Ministry issued a statement strongly criticizing Mr. Trump’s tariffs, which will begin to take effect on Saturday and fully kick in next Wednesday. “This practice of the U.S. is not in line with international trade rules, seriously undermines China’s legitimate rights and interests, and is a typical unilateral bullying practice,” the ministry said.

The Chinese tariffs are scheduled to take effect next Thursday — 12 hours after the American tariffs take effect.

On Friday morning in the United States, President Trump posted his reaction to China’s retaliation on Truth Social: “CHINA PLAYED IT WRONG, THEY PANICKED — THE ONE THING THEY CANNOT AFFORD TO DO!”

Jude Blanchette, director of the RAND China Research Center, said China’s forceful response was “inevitable” after Mr. Trump introduced his sweeping tariffs.

“Beijing can no longer maintain the fiction that diplomatic engagement with the Trump administration will prevent a full-scale trade war,” Mr. Blanchette said. “Despite White House warnings against retaliation, the total tariffs imposed on China are now so substantial that Beijing has little reason to exercise restraint.”

The escalatory cycle also further dims hope of any summit soon between Mr. Trump and China’s top leader, Xi Jinping. Mr. Xi’s aides have been wary of scheduling any meeting between the two men unless a detailed agenda and resolution of pending issues can be worked out in advance.

Friday’s countermeasures highlight the retaliatory toolbox at China’s disposal, one reason Beijing feels it is better prepared to weather a trade war with the United States today than it was during the first Trump administration, said Wang Dong, executive director of the Institute for Global Cooperation and Understanding at Peking University.

“If the Trump administration’s hope is to pressure China to cave in, then it’ll be a non-starter,” he said.

Mr. Wang said Beijing is also betting that Mr. Trump will come under growing pressure at home to ease some of his tariffs because of the harm it might do to the U.S. economy.

“China is in a better position to win this round of trade frictions,” Mr. Wang said.

Mr. Trump has contended that steep tariffs are essential to halt a long decline in America’s share of global manufacturing, by protecting the American market from a flood of imports. The White House has also said that the tariffs are needed to preserve the remaining industrial capacity of the United States to make munitions in case of military conflicts.

China’s ambitious “Made in China 2025” industrial policy, which began in 2015, has made the country largely self-reliant in the production of many industrial goods, from electric cars to solar panels. While Chinese officials were caught off guard by Mr. Trump’s trade actions in 2018 and 2019 and sometimes took a few days to respond, they have moved much faster this year.

They acted on Friday, 36 hours after his latest tariffs, even though it was a national holiday.

But the Chinese economy depends heavily on exports, which is why Mr. Trump’s tariffs have caused alarm in Beijing and across the country. China’s trade surplus last year in manufactured goods — the amount by which exports exceeded imports — was equal to a tenth of the entire economy and rising.

Chinese officials said this week that if tariffs restrict their access to the American market, they will shift exports to other markets. But China already runs large and widening surpluses with most of Europe and the developing world, triggering a wave of tariffs by countries elsewhere on Chinese goods.

China has been more cautious about responding to those tariffs, as it has tried to portray Washington as leading a global shift toward protectionism.

Mr. Trump also imposed steep tariffs this week on imports from dozens of other countries. Many of these countries rely on running large trade surpluses with the United States to pay for their big trade deficits with China.

Some of these countries — like Vietnam, Cambodia, Malaysia and Mexico — buy enormous quantities of components from China for assembly into finished goods for sale to the United States, with little or no tariffs paid. If the new U.S. tariffs stay in effect, China’s exports to these countries could also wither.

China’s new export licensing system for rare earth metals may trigger further difficulties for American industry, and possibly for companies in Europe and elsewhere as well. Previous introductions of export licenses for other minerals have resulted in months of delays as civil servants and companies figure out the new rules.

China imposed a two-month freeze on shipments of rare earths to Japan in 2010 during a territorial dispute.

The Obama administration responded by calling for the United States to restart its own mining and processing of rare earths, which mostly shut down in the 1990s. But 15 years after the Japan embargo, mining has resumed in the United States but most of the ore is shipped to China for processing into valuable materials, as rare earths refining has proved technically challenging.

Claire Fu contributed reporting from Seoul.

The Chinese government said it would match President Trump’s tariff, and also barred a group of American companies from doing business in China.

By Keith Bradsher and David Pierson

Keith Bradsher reported from Beijing and David Pierson from Hong Kong.

April 4, 2025

Updated 10:25 a.m. ET

China has struck back at President Trump.

On Friday evening in Beijing, in a rapid-fire series of policy announcements including 34 percent across-the-board tariffs, China showed that it has no intention of backing down in the trade war that Mr. Trump began this week with his own steep tariffs on imports from around the world.

China’s Finance Ministry said it will match Mr. Trump’s plan for 34 percent tariffs on goods from China with its own 34 percent tariff on imports from the United States.

Separately, China’s Ministry of Commerce said it was adding 11 American companies to its list of “unreliable entities,” essentially barring them from doing business in China or with Chinese companies. The ministry imposed a licensing system to restrict exports of seven rare earth elements that are mined and processed almost exclusively in China and are used in everything from electric cars to smart bombs.

The commerce ministry also announced it was beginning two trade investigations into American exports of medical imaging equipment — one of the few manufacturing categories in which the United States remains internationally competitive.

China’s General Administration of Customs said that it would halt chicken imports from five of America’s biggest exporters of agricultural commodities and sorghum imports from a sixth company.

And China’s State Administration for Market Regulation announced that it suspected the China division of DuPont, the American chemicals giant, had violated China’s antimonopoly law and would investigate. DuPont had said in a statement that it took the matter very seriously and was reviewing China’s claims.

China’s new 34 percent tariffs, which are in addition to previously imposed tariffs, will hit fewer goods than President Trump’s tariffs only because China sells far more to the United States than it buys. China bought $147.8 billion worth of American semiconductors, fossil fuels, agricultural goods and other products last year. It sold $426.9 billion worth of smartphones, furniture, toys and many other products to the United States.

China is America’s second-largest source of imports, after Mexico, and third-largest export market, after Canada and Mexico.

But while President Trump’s tariffs exempted some large categories of imports, like semiconductors and pharmaceuticals, the Chinese tariffs have no exemptions.

Beijing’s actions triggered a sharp decline in futures markets for American shares, and on Friday, the S&P 500 opened 2.5 percent lower after posting on Thursday its worst single-day result since 2020.

China’s Finance Ministry issued a statement strongly criticizing Mr. Trump’s tariffs, which will begin to take effect on Saturday and fully kick in next Wednesday. “This practice of the U.S. is not in line with international trade rules, seriously undermines China’s legitimate rights and interests, and is a typical unilateral bullying practice,” the ministry said.

The Chinese tariffs are scheduled to take effect next Thursday — 12 hours after the American tariffs take effect.

On Friday morning in the United States, President Trump posted his reaction to China’s retaliation on Truth Social: “CHINA PLAYED IT WRONG, THEY PANICKED — THE ONE THING THEY CANNOT AFFORD TO DO!”

Jude Blanchette, director of the RAND China Research Center, said China’s forceful response was “inevitable” after Mr. Trump introduced his sweeping tariffs.

“Beijing can no longer maintain the fiction that diplomatic engagement with the Trump administration will prevent a full-scale trade war,” Mr. Blanchette said. “Despite White House warnings against retaliation, the total tariffs imposed on China are now so substantial that Beijing has little reason to exercise restraint.”

The escalatory cycle also further dims hope of any summit soon between Mr. Trump and China’s top leader, Xi Jinping. Mr. Xi’s aides have been wary of scheduling any meeting between the two men unless a detailed agenda and resolution of pending issues can be worked out in advance.

Friday’s countermeasures highlight the retaliatory toolbox at China’s disposal, one reason Beijing feels it is better prepared to weather a trade war with the United States today than it was during the first Trump administration, said Wang Dong, executive director of the Institute for Global Cooperation and Understanding at Peking University.

“If the Trump administration’s hope is to pressure China to cave in, then it’ll be a non-starter,” he said.

Mr. Wang said Beijing is also betting that Mr. Trump will come under growing pressure at home to ease some of his tariffs because of the harm it might do to the U.S. economy.

“China is in a better position to win this round of trade frictions,” Mr. Wang said.

Mr. Trump has contended that steep tariffs are essential to halt a long decline in America’s share of global manufacturing, by protecting the American market from a flood of imports. The White House has also said that the tariffs are needed to preserve the remaining industrial capacity of the United States to make munitions in case of military conflicts.

China’s ambitious “Made in China 2025” industrial policy, which began in 2015, has made the country largely self-reliant in the production of many industrial goods, from electric cars to solar panels. While Chinese officials were caught off guard by Mr. Trump’s trade actions in 2018 and 2019 and sometimes took a few days to respond, they have moved much faster this year.

They acted on Friday, 36 hours after his latest tariffs, even though it was a national holiday.

But the Chinese economy depends heavily on exports, which is why Mr. Trump’s tariffs have caused alarm in Beijing and across the country. China’s trade surplus last year in manufactured goods — the amount by which exports exceeded imports — was equal to a tenth of the entire economy and rising.

Chinese officials said this week that if tariffs restrict their access to the American market, they will shift exports to other markets. But China already runs large and widening surpluses with most of Europe and the developing world, triggering a wave of tariffs by countries elsewhere on Chinese goods.

China has been more cautious about responding to those tariffs, as it has tried to portray Washington as leading a global shift toward protectionism.

Mr. Trump also imposed steep tariffs this week on imports from dozens of other countries. Many of these countries rely on running large trade surpluses with the United States to pay for their big trade deficits with China.

Some of these countries — like Vietnam, Cambodia, Malaysia and Mexico — buy enormous quantities of components from China for assembly into finished goods for sale to the United States, with little or no tariffs paid. If the new U.S. tariffs stay in effect, China’s exports to these countries could also wither.

China’s new export licensing system for rare earth metals may trigger further difficulties for American industry, and possibly for companies in Europe and elsewhere as well. Previous introductions of export licenses for other minerals have resulted in months of delays as civil servants and companies figure out the new rules.

China imposed a two-month freeze on shipments of rare earths to Japan in 2010 during a territorial dispute.

The Obama administration responded by calling for the United States to restart its own mining and processing of rare earths, which mostly shut down in the 1990s. But 15 years after the Japan embargo, mining has resumed in the United States but most of the ore is shipped to China for processing into valuable materials, as rare earths refining has proved technically challenging.

Claire Fu contributed reporting from Seoul.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ponchi101

- Site Admin

- Posts: 18888

- Joined: Mon Dec 07, 2020 4:40 pm

- Location: New Macondo

- Has thanked: 4118 times

- Been thanked: 6996 times

- Contact:

Re: Business/Markets/Stocks/Economics Random, Random

I agree on tariffs for Chinese goods. S. American countries simply cannot compete with China and we will never be able to develop any sort of industrial sector if we don't impose tariffs on them. Plus, they manipulate their currency.

Having said that: too late! (for tariffs to be imposed).

Having said that: too late! (for tariffs to be imposed).

Ego figere omnia et scio supellectilem

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Linda Yueh @lindayueh.bsky.social

·

15m

Nasdaq enters bear territory defined as an index which falls by 20% or more

Tech companies rely on trade and manufacturing in China, so this sector has taken a significant knock from Trump’s 34% on Chinese goods — and Beijing’s retaliatory 34% levy on US goods.

www.thetimes.com/us/news-toda...

·

15m

Nasdaq enters bear territory defined as an index which falls by 20% or more

Tech companies rely on trade and manufacturing in China, so this sector has taken a significant knock from Trump’s 34% on Chinese goods — and Beijing’s retaliatory 34% levy on US goods.

www.thetimes.com/us/news-toda...

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

Owendonovan

- Posts: 1760

- Joined: Wed Dec 08, 2021 3:08 am

- Location: NYC

- Has thanked: 1473 times

- Been thanked: 1067 times

Re: Business/Markets/Stocks/Economics Random, Random

Oh sure. The only thing any country should be interested in is the success of the USA. Idiot.ti-amie wrote: ↑Thu Apr 03, 2025 11:19 pm Treasury Secretary urges other countries to 'take a deep breath' and not retaliate

https://www.cnn.com/2025/04/02/politics ... ntv-digvid

Video

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Aaron Rupar

@atrupar.com

Kudlow: "Buying cheap goods is not a real prosperity, and we don't have to accept that. So you lay the law down, that's all. Look, all the badly behaving children in Asia and elsewhere are coming home to papa. They're all on the phone begging for mercy."

Video at the link

https://bsky.app/profile/atrupar.com/post/3llzckvzwax2o

@atrupar.com

Kudlow: "Buying cheap goods is not a real prosperity, and we don't have to accept that. So you lay the law down, that's all. Look, all the badly behaving children in Asia and elsewhere are coming home to papa. They're all on the phone begging for mercy."

Video at the link

https://bsky.app/profile/atrupar.com/post/3llzckvzwax2o

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

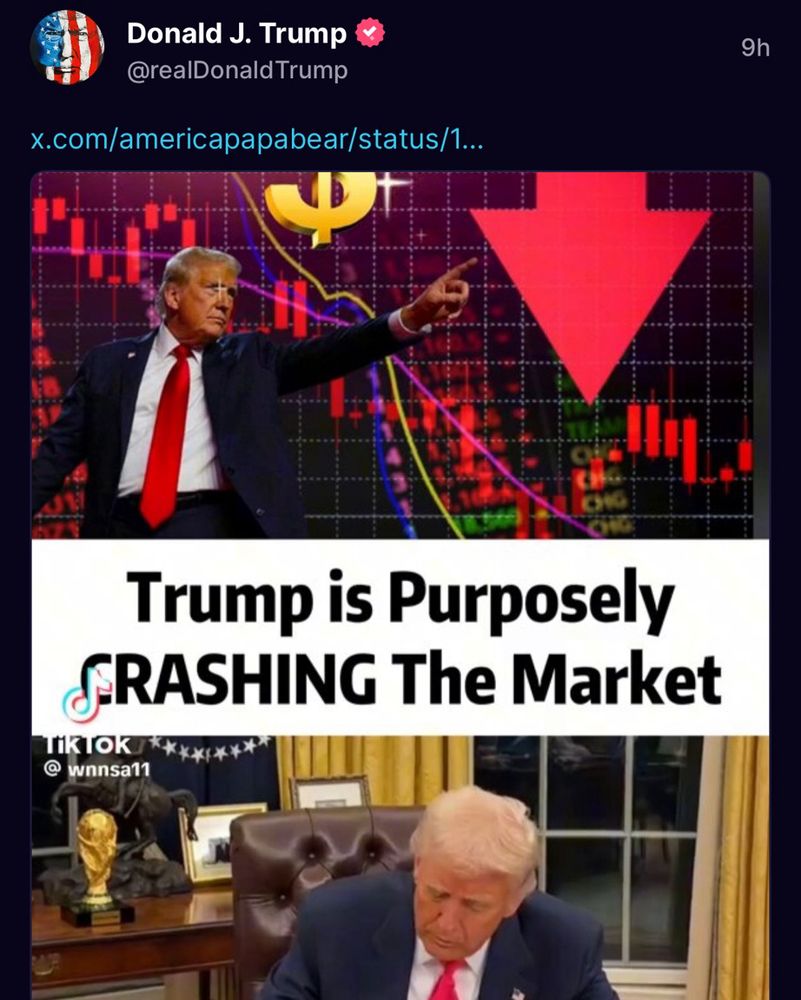

Anna Bower

@annabower.bsky.social

he…..he actually posted this

@annabower.bsky.social

he…..he actually posted this

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Today's final numbers

SYMBOL PRICE CHANGE %CHANGE

DJIA

38,314.86 -2,231.07 -5.5

NASDAQ

15,587.79 -962.82 -5.82

S&P 500

5,074.08 -322.44 -5.97

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Carl Quintanilla @carlquintanilla.bsky.social

·

36m

WAPO: “.. The proposal to spin off .. TikTok was shattered when the Chinese government said it would not approve any deal without discussing President Donald Trump’s tariffs and trade policy, three people close to the negotiations said.”

@drewharwell.com

www.washingtonpost.com/technology/2...

·

36m

WAPO: “.. The proposal to spin off .. TikTok was shattered when the Chinese government said it would not approve any deal without discussing President Donald Trump’s tariffs and trade policy, three people close to the negotiations said.”

@drewharwell.com

www.washingtonpost.com/technology/2...

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Catherine RampellJoey Politano @josephpolitano.bsky.social

·

47m

lots of US companies turn aluminum into planes for foreigners, guess what happens when you whack them on both ends

@crampell.bsky.social

Follow

Pittsburgh-based aerospace company, which sells parts to the major aviation companies, has declared a force majeure in the wake of Trump's tariffs so it can break contract obligations

www.reuters.com/business/aer...

https://www.reuters.com/business/aerosp ... 025-04-04/

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Aaron Rupar @atrupar.comCatherine Rampell

@crampell.bsky.social

Follow

When Trump took office in January, unemployment was 4%. We'd just wrapped up a year of 2.8% GDP growth.

These numbers do not a "depression" make

·

1d

obscene lying from Stephen Miller on Fox News as he claims the economy was in "depression" thanks to Biden when Trump took office (the American economy was in fact the envy of the world three months ago ... )

As Ponchi said in another thread they know MAGAts were not paying attention to the economy so they can go on Faux, lie, and be believed.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

r/StockMarket

•

2 days ago

Apprehensive-Mark241

Most of the media hasn't picked up the fact that THERE ARE NO TARIFFS that Trump is retaliating for! The fact he can be THIS wrong and no one tells him he's wrong shows that he's effectively a dictator in function in the administration.

News

I'm copying this from the group I posted it to because this group won't accept crossposts.

https://www.mediaite.com/trump/trump-us ... e-tariffs/

How are we even going to deal with this level of stupidity?

Looking at the alleged tariffs other countries are supposedly levying on U.S. goods, one might be struck by the exorbitant rates in some cases. For example, if China were really imposing a 67% tariff on U.S. goods or if Vietnam were implementing a 90% tariff on U.S. products, that’s something that likely would have been retaliated against a long time ago. But in fact, these numbers do not represent “tariffs.”

Take the E.U. “tariff” on U.S. goods of 39%. In 2024, the U.S. exported $370.2 billion to the E.U., according to the Office of the U.S. Trade Representative. Meanwhile, the U.S. imported $605.8 billion from the E.U. That means the U.S. ran a trade deficit with the E.U. of $235.6 billion.

What the Trump administration seems to have done is taken the deficit ($235.6 billion) and divided it by the total number of imports from the E.U. ($605.8 billion), yielding a figure of 38.89%, which the administration rounded up to 39% and called a “Tariff to the U.S.A.” imposed by the E.U. But obviously, that is not a tariff.

So to make this clear, since we buy 97% more from Cambodia than they buy from us, he said they have a 97% tariff on us and imposed a 49% tariff in retaliation.

And that number is not only the wrong THING it's also the wrong number because Trump only counted goods and 1/3 of US exports are services.

So so so so so so so so stupid!

Now consider that the Council of Economic Advisers knows perfectly well the difference between the balance of trade and a tariff, but they can't tell him because he's such a raging narcissist that no one can ever disagree with him and you have to do what he says or he'll make you his next enemy.

So they printed up that table for him to carry to his speech, knowing that 100% of what is printed on it is absolute nonsense.

And because he's a narcissist he wants to be your dictator, to invade Panama, Greenland and Canada. And because he has malignant narcissism as a severe personality disorder and is deeply mentally ill, he wants to do this while basking in the radiance of Vladimir Putin who he worships and who he emotionally confuses with himself!

For instance (it took a long time to find a transcript that left in the scary insanity and didn't sane wash Trump):

“She is asking what if Russia breaks the ceasefire.”

Trump: “What, if anything? What if the bomb drops on your head right now? OK, what if they broke it? I don’t know, they broke it with Biden because Biden, they didn’t respect him. They didn’t respect Obama. They respect me. Let me tell you, Putin went through a hell of a lot with me. He went through a phony witch hunt where they used him and Russia, Russia, Russia! You ever hear of that deal? That was a phony Hunter Biden, Joe Biden scam. ... And he had to go through that Hillary Clinton, shifty Adam Schiff. It was a Democrat scam. And he had to go through that. And he did go through it. We didn’t end up in a war. And he went through it. He was accused of all that stuff. He had nothing to do with it. It came out of Hunter Biden’s bathroom. It came out of Hunter Biden’s bedroom. It was disgusting. And then they said, ‘Oh, the laptop from hell was made by Russia.’ The 51 agents. The whole thing was a scam. And he had to put up with that. He was being accused of all that stuff. All I can say is this: … All I can say is this. He might have broken deals with Obama and Bush, and he might have broken them with Biden. He did, maybe. Maybe he did. I don’t know what happened, but he didn’t break them with me. He wants to make a deal. I don’t know if you can make a deal.”

I'd like to add that if Trump IS doing this on purpose, then the idea is to threaten all of the billionaires and corporations so that they come crawling to him and he can force them to support his dictatorship in return for not immediately putting them out of business. I think he stumbled onto a strategy of deliberately hurting the country by accident. He's a confused old man, but he'll do anything for a big enough bribe. So this works for him.

Congress, not the President is supposed to be in charge of tariffs. Trump is using some (expletive) emergency war power. Congress can and should put an end to this charade.

He has the power to veto congress, but I think he's going to crash the economy and stock market so deeply into depression that an override will be easy to get! I feel weird making any predictions, but Trump is so disconnected from reality that the situation is that bad.

•

2 days ago

Apprehensive-Mark241

Most of the media hasn't picked up the fact that THERE ARE NO TARIFFS that Trump is retaliating for! The fact he can be THIS wrong and no one tells him he's wrong shows that he's effectively a dictator in function in the administration.

News

I'm copying this from the group I posted it to because this group won't accept crossposts.

https://www.mediaite.com/trump/trump-us ... e-tariffs/

How are we even going to deal with this level of stupidity?

Looking at the alleged tariffs other countries are supposedly levying on U.S. goods, one might be struck by the exorbitant rates in some cases. For example, if China were really imposing a 67% tariff on U.S. goods or if Vietnam were implementing a 90% tariff on U.S. products, that’s something that likely would have been retaliated against a long time ago. But in fact, these numbers do not represent “tariffs.”

Take the E.U. “tariff” on U.S. goods of 39%. In 2024, the U.S. exported $370.2 billion to the E.U., according to the Office of the U.S. Trade Representative. Meanwhile, the U.S. imported $605.8 billion from the E.U. That means the U.S. ran a trade deficit with the E.U. of $235.6 billion.

What the Trump administration seems to have done is taken the deficit ($235.6 billion) and divided it by the total number of imports from the E.U. ($605.8 billion), yielding a figure of 38.89%, which the administration rounded up to 39% and called a “Tariff to the U.S.A.” imposed by the E.U. But obviously, that is not a tariff.

So to make this clear, since we buy 97% more from Cambodia than they buy from us, he said they have a 97% tariff on us and imposed a 49% tariff in retaliation.

And that number is not only the wrong THING it's also the wrong number because Trump only counted goods and 1/3 of US exports are services.

So so so so so so so so stupid!

Now consider that the Council of Economic Advisers knows perfectly well the difference between the balance of trade and a tariff, but they can't tell him because he's such a raging narcissist that no one can ever disagree with him and you have to do what he says or he'll make you his next enemy.

So they printed up that table for him to carry to his speech, knowing that 100% of what is printed on it is absolute nonsense.

And because he's a narcissist he wants to be your dictator, to invade Panama, Greenland and Canada. And because he has malignant narcissism as a severe personality disorder and is deeply mentally ill, he wants to do this while basking in the radiance of Vladimir Putin who he worships and who he emotionally confuses with himself!

For instance (it took a long time to find a transcript that left in the scary insanity and didn't sane wash Trump):

“She is asking what if Russia breaks the ceasefire.”

Trump: “What, if anything? What if the bomb drops on your head right now? OK, what if they broke it? I don’t know, they broke it with Biden because Biden, they didn’t respect him. They didn’t respect Obama. They respect me. Let me tell you, Putin went through a hell of a lot with me. He went through a phony witch hunt where they used him and Russia, Russia, Russia! You ever hear of that deal? That was a phony Hunter Biden, Joe Biden scam. ... And he had to go through that Hillary Clinton, shifty Adam Schiff. It was a Democrat scam. And he had to go through that. And he did go through it. We didn’t end up in a war. And he went through it. He was accused of all that stuff. He had nothing to do with it. It came out of Hunter Biden’s bathroom. It came out of Hunter Biden’s bedroom. It was disgusting. And then they said, ‘Oh, the laptop from hell was made by Russia.’ The 51 agents. The whole thing was a scam. And he had to put up with that. He was being accused of all that stuff. All I can say is this: … All I can say is this. He might have broken deals with Obama and Bush, and he might have broken them with Biden. He did, maybe. Maybe he did. I don’t know what happened, but he didn’t break them with me. He wants to make a deal. I don’t know if you can make a deal.”

I'd like to add that if Trump IS doing this on purpose, then the idea is to threaten all of the billionaires and corporations so that they come crawling to him and he can force them to support his dictatorship in return for not immediately putting them out of business. I think he stumbled onto a strategy of deliberately hurting the country by accident. He's a confused old man, but he'll do anything for a big enough bribe. So this works for him.

Congress, not the President is supposed to be in charge of tariffs. Trump is using some (expletive) emergency war power. Congress can and should put an end to this charade.

He has the power to veto congress, but I think he's going to crash the economy and stock market so deeply into depression that an override will be easy to get! I feel weird making any predictions, but Trump is so disconnected from reality that the situation is that bad.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Carl Quintanilla @carlquintanilla.bsky.social

·

1h

Cabinet member worth $500 million speaks.

@nbcnews.com

www.nbcnews.com/politics/tru...

·

1h

Cabinet member worth $500 million speaks.

@nbcnews.com

www.nbcnews.com/politics/tru...

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

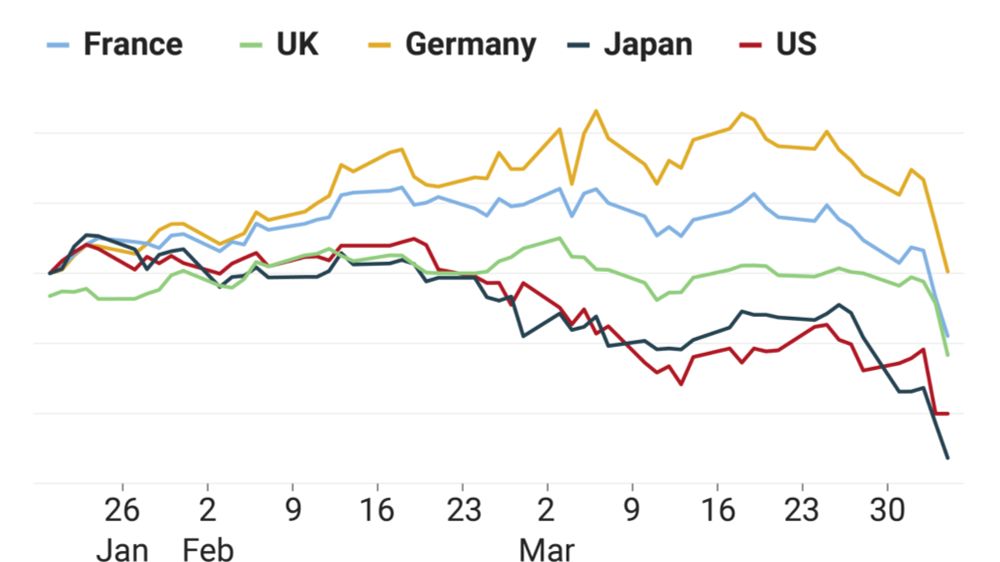

Meanwhile...

Ray Douglas

@raydouglas.bsky.social

Follow

The futures markets for tomorrow's trading on Wall Street is looking ugly

As things stand, last week's huge equities sell-off will continue...

#tariffs

Ray Douglas

@raydouglas.bsky.social

Follow

The futures markets for tomorrow's trading on Wall Street is looking ugly

As things stand, last week's huge equities sell-off will continue...

#tariffs

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

US stock futures tumble as officials offer no respite from tariffs

Declines come after the worst week for Wall Street equities since the pandemic

George Steer in New York

Published

2 hours ago

Updated

18:42

US stock-index futures dropped sharply on Sunday after the Trump administration indicated that sweeping tariffs would be kept in place despite fears they could induce a global economic recession.

Contracts tracking the blue-chip S&P 500 fell 3.8 per cent and those for the tech-heavy Nasdaq 100 slid 4.6 per cent. Trading activity is typically light early in the Asian morning, which can exacerbate volatility.

The declines come after more than $5tn was erased from the S&P 500 on Thursday and Friday at the end of its worst week since the onset of the pandemic in 2020. Donald Trump’s move to upend the global trade order by implementing huge levies on US imports has deepened concerns about the trajectory of the world’s economy. China announced retaliatory duties on Friday of 34 per cent.

Commodities also sustained heavy losses in early trading Sunday night, with West Texas Intermediate, the US benchmark, falling 3.4 per cent to $59.90 a barrel — below the price needed by most shale producers to break even. International marker Brent dropped 3.1 per cent to $63.53.

Copper, widely seen as a proxy for the global economy because of its industrial uses, fell more than 5 per cent to $4.14 a pound in US trading.

Over the weekend, Trump’s Treasury secretary Scott Bessent dismissed the “short-term” market reaction to the president’s aggressive tariffs, telling NBC that the White House will “hold the course”.

“Our trading partners have taken advantage of us,” Bessent said on Sunday. Asked whether Trump’s tariffs were negotiable, he said: “We’re going to have to see what [other] countries offer and whether it’s believable”.

His comments followed a warning from Federal Reserve chair Jay Powell that the tariffs would stoke “higher inflation and slower growth”.

JPMorgan economists said on Friday they expected the world’s biggest economy to contract 0.3 per cent this year “under the weight of tariffs”. They had previously forecast US growth of 1.3 per cent.

Some investors worry stocks will continue to slide until Trump indicates that his tariffs will be less aggressive.

Activist investor Bill Ackman, who vocally backed Trump during the election campaign, posted on X that “massive and disproportionate tariffs” risked “destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital.”

He urged Trump to call “time out” on Monday.

“Alternatively, we are heading for a self-induced, economic nuclear winter, and we should start hunkering down,” he wrote.

Dec Mullarkey, managing director at SLC Management, said: “Uncertainty is the big word right now and we’re not even at peak policy uncertainty yet.”

Banks and technology stocks were among those hardest hit last week as the dollar sank against other major currencies, and Treasury yields, which move inversely to prices, tumbled as investors rushed into perceived safe haven assets. European and Asian equities markets also fell sharply, while commodities including copper and oil dropped on fears of a global trade war.

Friday marked the fifth largest session of “active net reductions” by investors since 2010, according to Morgan Stanley, with equity long-short funds responsible for 80 per cent of the net selling.

The S&P 500’s more than 10 per cent decline over Thursday and Friday is only the fourth time in the past 85 years — after the 1987 crash, in 2008 during the financial crisis and in early 2020 — that the index has fallen so far, so fast, according to Deutsche Bank.

Copyright The Financial Times Limited 2025. All rights reserved.

https://www.ft.com/content/c2c10cca-bc1 ... 1b37ac987f

Declines come after the worst week for Wall Street equities since the pandemic

George Steer in New York

Published

2 hours ago

Updated

18:42

US stock-index futures dropped sharply on Sunday after the Trump administration indicated that sweeping tariffs would be kept in place despite fears they could induce a global economic recession.

Contracts tracking the blue-chip S&P 500 fell 3.8 per cent and those for the tech-heavy Nasdaq 100 slid 4.6 per cent. Trading activity is typically light early in the Asian morning, which can exacerbate volatility.

The declines come after more than $5tn was erased from the S&P 500 on Thursday and Friday at the end of its worst week since the onset of the pandemic in 2020. Donald Trump’s move to upend the global trade order by implementing huge levies on US imports has deepened concerns about the trajectory of the world’s economy. China announced retaliatory duties on Friday of 34 per cent.

Commodities also sustained heavy losses in early trading Sunday night, with West Texas Intermediate, the US benchmark, falling 3.4 per cent to $59.90 a barrel — below the price needed by most shale producers to break even. International marker Brent dropped 3.1 per cent to $63.53.

Copper, widely seen as a proxy for the global economy because of its industrial uses, fell more than 5 per cent to $4.14 a pound in US trading.

Over the weekend, Trump’s Treasury secretary Scott Bessent dismissed the “short-term” market reaction to the president’s aggressive tariffs, telling NBC that the White House will “hold the course”.

“Our trading partners have taken advantage of us,” Bessent said on Sunday. Asked whether Trump’s tariffs were negotiable, he said: “We’re going to have to see what [other] countries offer and whether it’s believable”.

His comments followed a warning from Federal Reserve chair Jay Powell that the tariffs would stoke “higher inflation and slower growth”.

JPMorgan economists said on Friday they expected the world’s biggest economy to contract 0.3 per cent this year “under the weight of tariffs”. They had previously forecast US growth of 1.3 per cent.

Some investors worry stocks will continue to slide until Trump indicates that his tariffs will be less aggressive.

Activist investor Bill Ackman, who vocally backed Trump during the election campaign, posted on X that “massive and disproportionate tariffs” risked “destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital.”

He urged Trump to call “time out” on Monday.

“Alternatively, we are heading for a self-induced, economic nuclear winter, and we should start hunkering down,” he wrote.

Dec Mullarkey, managing director at SLC Management, said: “Uncertainty is the big word right now and we’re not even at peak policy uncertainty yet.”

Banks and technology stocks were among those hardest hit last week as the dollar sank against other major currencies, and Treasury yields, which move inversely to prices, tumbled as investors rushed into perceived safe haven assets. European and Asian equities markets also fell sharply, while commodities including copper and oil dropped on fears of a global trade war.

Friday marked the fifth largest session of “active net reductions” by investors since 2010, according to Morgan Stanley, with equity long-short funds responsible for 80 per cent of the net selling.

The S&P 500’s more than 10 per cent decline over Thursday and Friday is only the fourth time in the past 85 years — after the 1987 crash, in 2008 during the financial crisis and in early 2020 — that the index has fallen so far, so fast, according to Deutsche Bank.

Copyright The Financial Times Limited 2025. All rights reserved.

https://www.ft.com/content/c2c10cca-bc1 ... 1b37ac987f

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32057

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6194 times

- Been thanked: 4204 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Joey Politano @josephpolitano.bsky.social

@josephpolitano.bsky.social

·

25m

More deranged tariff poasting from the White House

·

25m

More deranged tariff poasting from the White House

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

Who is online

Users browsing this forum: No registered users and 7 guests