Scheduled Maintenance: We need to purge all sessions. You will need to login again.

Business/Markets/Stocks/Economics Random, Random

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

We now live in a time when people trust statements from China more than whatever mess Tiny is spewing. If anyone had told me this twenty years ago I would've called 911 on them.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Then there's this.

Carl Quintanilla

@carlquintanilla.bsky.social

$NVDA

@barchart.com

Carl Quintanilla

@carlquintanilla.bsky.social

$NVDA

@barchart.com

coolhandluke123.bsky.social

@coolhandluke123.bsky.social

· 6m

The AI snake oil is being found out.

adlangx

@adlangx.bsky.social

· 32m

There is not enough demand for AI.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Carl Quintanilla

@carlquintanilla.bsky.social

· 9m

This is some Ali-level rope-a-dope.

@justinwolfers.bsky.social

@carlquintanilla.bsky.social

· 9m

This is some Ali-level rope-a-dope.

@justinwolfers.bsky.social

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Joey Politano

@josephpolitano.bsky.social

Follow

Well well well, If it isn’t the consequences of my own actions

@josephpolitano.bsky.social

Follow

Well well well, If it isn’t the consequences of my own actions

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ponchi101

- Site Admin

- Posts: 18885

- Joined: Mon Dec 07, 2020 4:40 pm

- Location: New Macondo

- Has thanked: 4117 times

- Been thanked: 6991 times

- Contact:

Re: Business/Markets/Stocks/Economics Random, Random

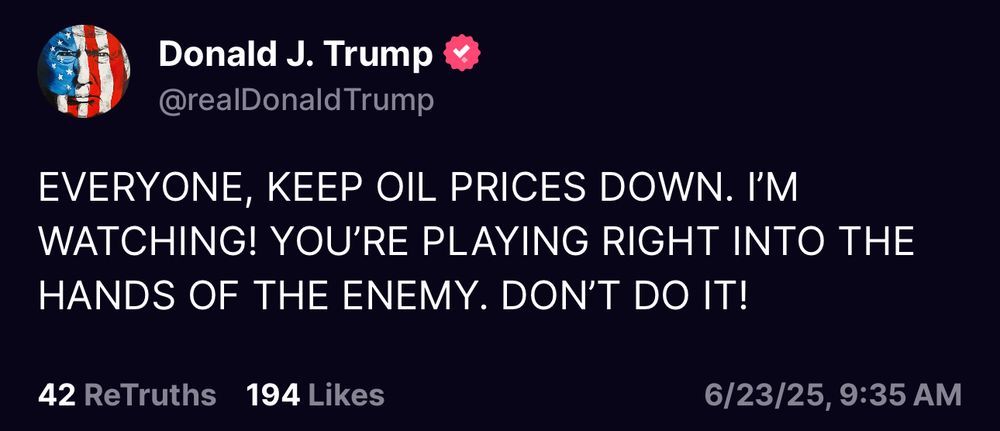

He is such a little kid.

Ego figere omnia et scio supellectilem

- dryrunguy

- Posts: 1967

- Joined: Thu Dec 10, 2020 6:31 am

- Has thanked: 866 times

- Been thanked: 1079 times

Re: Business/Markets/Stocks/Economics Random, Random

There's no need to insult the child community, ponchi.

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

He's like this brat.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Germany, Italy pressured to repatriate $245B worth of gold from US

Staff Writer | June 25, 2025 | 9:32 am Markets Europe USA Gold

Bundesbank gold vault in Frankfurt. Credit: Bundesbank/Nils Thies

Germany and Italy are facing mounting pressure to repatriate a combined $245 billion worth of gold stored in the Federal Reserve vaults of New York, the Financial Times reported this week.

According to FT, politicians and taxpayer advocacy groups in Europe have voiced deep concerns over the safety of their gold following verbal attacks by US President Donald Trump on the Federal Reserve. Storing bullion abroad can expose Europe’s financial sovereignty to unnecessary risk, they said.

Leading the push is Fabio De Masi, a former member of the European Parliament and now affiliated with Germany’s new left-wing populist BSW party. Speaking to FT, De Masi said there are “strong arguments” to bring more of Germany’s bullion back home.

Germany began storing a significant portion of its gold reserves in the US during the post-WW2 economic boom. As of today, about a third of its gold (1,200 tonnes) remains with the New York Federal Reserve in Manhattan.

Earlier this year, German newspaper Bild reported that a number of senior figures within the center-right Christian Democratic Union (CDU) party have discussed the possibility of pulling its gold stockpile out of the US under the current political climate.

Fed independence concerns

The Taxpayers Association of Europe (TAE) shared similar concerns, with its president Michael Jäger urging Germany’s finance ministry and central bank (and those of Italy) to reduce their dependency on the Federal Reserve.

“Trump wants to control the Fed, which would also mean controlling the German gold reserves in the US,” Jäger said in a Reuters interview. “It’s our money, it should be brought back.”

In Italy, economic commentator Enrico Grazzini recently warned in the newspaper Il Fatto Quotidiano that “leaving 43% of Italy’s gold reserves in America under the unreliable Trump administration is very dangerous for the national interest.”

Germany and Italy currently hold the world’s second and third-largest gold reserves at 3,352 tonnes and 2,452 tonnes, respectively. The US, meanwhile, is by far the largest holder at 8,133 tonnes.

Since returning to office, Trump has repeatedly voiced strong — and sometimes aggressive — criticism of Federal Reserve Chair Jerome Powell. This, according to the TAE, undermines its confidence in the US central bank’s independence, and the status of Europe’s gold going forward.

https://www.mining.com/germany-italy-fa ... held-in-us

Staff Writer | June 25, 2025 | 9:32 am Markets Europe USA Gold

Bundesbank gold vault in Frankfurt. Credit: Bundesbank/Nils Thies

Germany and Italy are facing mounting pressure to repatriate a combined $245 billion worth of gold stored in the Federal Reserve vaults of New York, the Financial Times reported this week.

According to FT, politicians and taxpayer advocacy groups in Europe have voiced deep concerns over the safety of their gold following verbal attacks by US President Donald Trump on the Federal Reserve. Storing bullion abroad can expose Europe’s financial sovereignty to unnecessary risk, they said.

Leading the push is Fabio De Masi, a former member of the European Parliament and now affiliated with Germany’s new left-wing populist BSW party. Speaking to FT, De Masi said there are “strong arguments” to bring more of Germany’s bullion back home.

Germany began storing a significant portion of its gold reserves in the US during the post-WW2 economic boom. As of today, about a third of its gold (1,200 tonnes) remains with the New York Federal Reserve in Manhattan.

Earlier this year, German newspaper Bild reported that a number of senior figures within the center-right Christian Democratic Union (CDU) party have discussed the possibility of pulling its gold stockpile out of the US under the current political climate.

Fed independence concerns

The Taxpayers Association of Europe (TAE) shared similar concerns, with its president Michael Jäger urging Germany’s finance ministry and central bank (and those of Italy) to reduce their dependency on the Federal Reserve.

“Trump wants to control the Fed, which would also mean controlling the German gold reserves in the US,” Jäger said in a Reuters interview. “It’s our money, it should be brought back.”

In Italy, economic commentator Enrico Grazzini recently warned in the newspaper Il Fatto Quotidiano that “leaving 43% of Italy’s gold reserves in America under the unreliable Trump administration is very dangerous for the national interest.”

Germany and Italy currently hold the world’s second and third-largest gold reserves at 3,352 tonnes and 2,452 tonnes, respectively. The US, meanwhile, is by far the largest holder at 8,133 tonnes.

Since returning to office, Trump has repeatedly voiced strong — and sometimes aggressive — criticism of Federal Reserve Chair Jerome Powell. This, according to the TAE, undermines its confidence in the US central bank’s independence, and the status of Europe’s gold going forward.

https://www.mining.com/germany-italy-fa ... held-in-us

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

US lawmakers push for comprehensive audit of Fort Knox gold

Staff Writer | June 8, 2025 | 8:01 am Regulatory Issues USA Gold

The US Bullion Depository, often known as Fort Knox. (Image courtesy of Wikimedia Commons.)

A group of Republican lawmakers has introduced a bill to initiate the first comprehensive audit of US gold reserves since the 1950s, citing the need for greater transparency over the nation’s bullion holdings.

The legislation, titled the Gold Reserve Transparency Act of 2025, was introduced Friday by US Congress member Thomas Massie (R-KY), alongside Troy Nehls (R-TX), Addison McDowell (R-NC) and Warren Davidson (R-OH) as co-sponsors.

If passed, the bill would require the Government Accountability Office (GAO) to conduct a full physical assay and inventory of America’s gold holdings within one year. It also mandates disclosure of all gold-related transactions over the past 50 years, including loans, leases, swaps, encumbrances, purchases and sales.

“The American people deserve to know whether the gold reserves are where they should be and whether they are being managed properly,” Massie said in a statement.

The US currently holds more gold in its reserves than any other nation at approximately 8,133 metric tons, according to Treasury Department data. The largest portion—more than 147 million ounces—is stored in Fort Knox, Kentucky. The remainder are held at West Point, the Denver Mint and the Federal Reserve Bank of New York.

Earlier this year, US President Donald Trump called for a visit to Fort Knox to verify that America’s gold reserves are still intact.

The Treasury, meanwhile, has maintained that an annual audit is performed, and all gold is “present and accounted for.”

‘Full disclosure’

The Gold Reserve Transparency Act proposes that similar audits be repeated at least every five years to ensure ongoing transparency and prevent lapses in record-keeping. It would provide “the full disclosure President Trump seeks,” Massie wrote on his X account.

The bill’s introduction comes a day after the viral social media clash between Trump and his former advisor Elon Musk, who first floated the idea of livestreaming a Fort Knox gold audit in February.

Proponents of the measure contend that independent oversight will help restore confidence in US financial stability amid growing global demand for gold and persistent conspiracy theories questioning the integrity of Fort Knox.

“The lack of proper audits of America’s gold is highly alarming and totally unacceptable — such shoddy procedures would never pass muster in the private sector,” Stefan Gleason, CEO of Money Metals Depository, said in support of the bill.

“It’s been literally decades since actual inventories and assays have been conducted with respect to US gold reserves, and the Department of the Treasury has lost records, as well as failed to account for many occasions when vault compartments were inexplicably opened and resealed without new audits,” Gleason added.

Still, the proposal faces an uncertain future in the Senate, where Democrat backing would likely be required. If passed, the GAO would embark on its audit within a year and institutions would face recurring reviews thereafter.

https://www.mining.com/us-lawmakers-pus ... knox-gold/

Staff Writer | June 8, 2025 | 8:01 am Regulatory Issues USA Gold

The US Bullion Depository, often known as Fort Knox. (Image courtesy of Wikimedia Commons.)

A group of Republican lawmakers has introduced a bill to initiate the first comprehensive audit of US gold reserves since the 1950s, citing the need for greater transparency over the nation’s bullion holdings.

The legislation, titled the Gold Reserve Transparency Act of 2025, was introduced Friday by US Congress member Thomas Massie (R-KY), alongside Troy Nehls (R-TX), Addison McDowell (R-NC) and Warren Davidson (R-OH) as co-sponsors.

If passed, the bill would require the Government Accountability Office (GAO) to conduct a full physical assay and inventory of America’s gold holdings within one year. It also mandates disclosure of all gold-related transactions over the past 50 years, including loans, leases, swaps, encumbrances, purchases and sales.

“The American people deserve to know whether the gold reserves are where they should be and whether they are being managed properly,” Massie said in a statement.

The US currently holds more gold in its reserves than any other nation at approximately 8,133 metric tons, according to Treasury Department data. The largest portion—more than 147 million ounces—is stored in Fort Knox, Kentucky. The remainder are held at West Point, the Denver Mint and the Federal Reserve Bank of New York.

Earlier this year, US President Donald Trump called for a visit to Fort Knox to verify that America’s gold reserves are still intact.

The Treasury, meanwhile, has maintained that an annual audit is performed, and all gold is “present and accounted for.”

‘Full disclosure’

The Gold Reserve Transparency Act proposes that similar audits be repeated at least every five years to ensure ongoing transparency and prevent lapses in record-keeping. It would provide “the full disclosure President Trump seeks,” Massie wrote on his X account.

The bill’s introduction comes a day after the viral social media clash between Trump and his former advisor Elon Musk, who first floated the idea of livestreaming a Fort Knox gold audit in February.

Proponents of the measure contend that independent oversight will help restore confidence in US financial stability amid growing global demand for gold and persistent conspiracy theories questioning the integrity of Fort Knox.

“The lack of proper audits of America’s gold is highly alarming and totally unacceptable — such shoddy procedures would never pass muster in the private sector,” Stefan Gleason, CEO of Money Metals Depository, said in support of the bill.

“It’s been literally decades since actual inventories and assays have been conducted with respect to US gold reserves, and the Department of the Treasury has lost records, as well as failed to account for many occasions when vault compartments were inexplicably opened and resealed without new audits,” Gleason added.

Still, the proposal faces an uncertain future in the Senate, where Democrat backing would likely be required. If passed, the GAO would embark on its audit within a year and institutions would face recurring reviews thereafter.

https://www.mining.com/us-lawmakers-pus ... knox-gold/

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

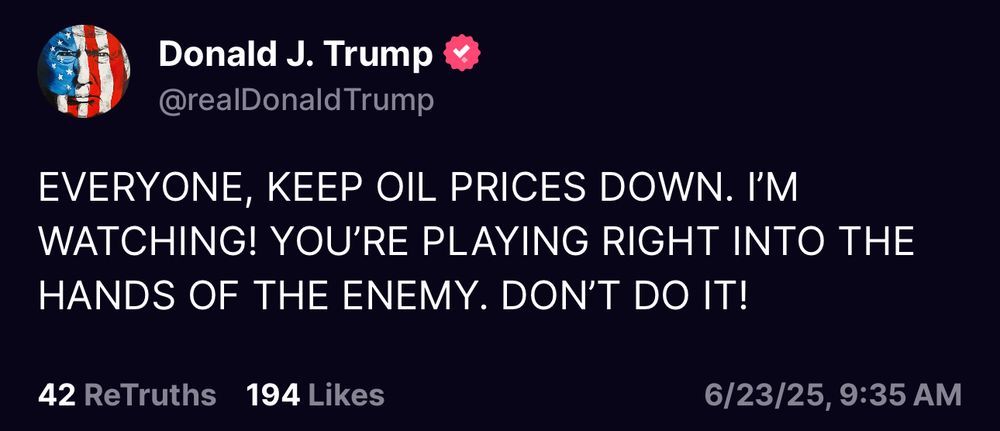

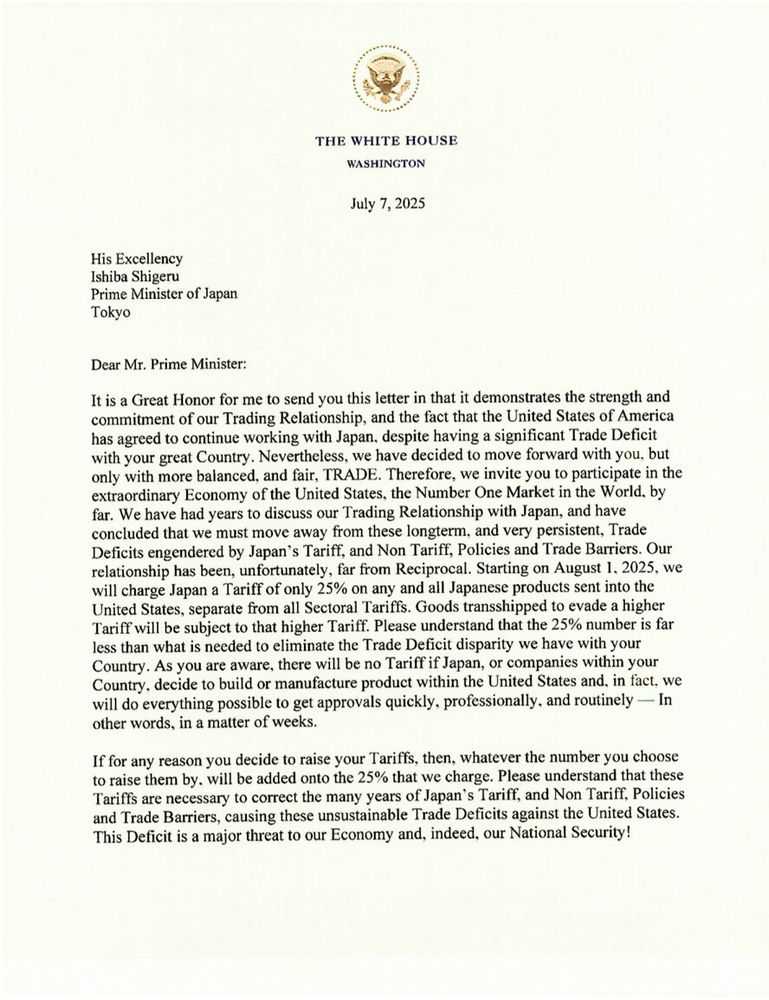

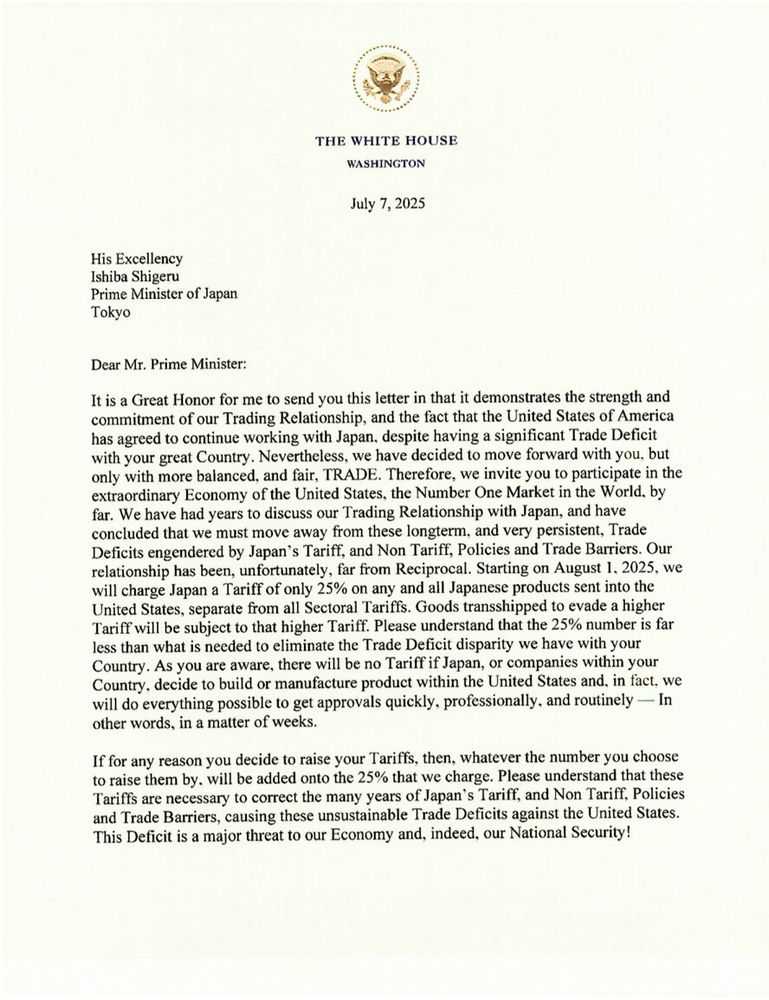

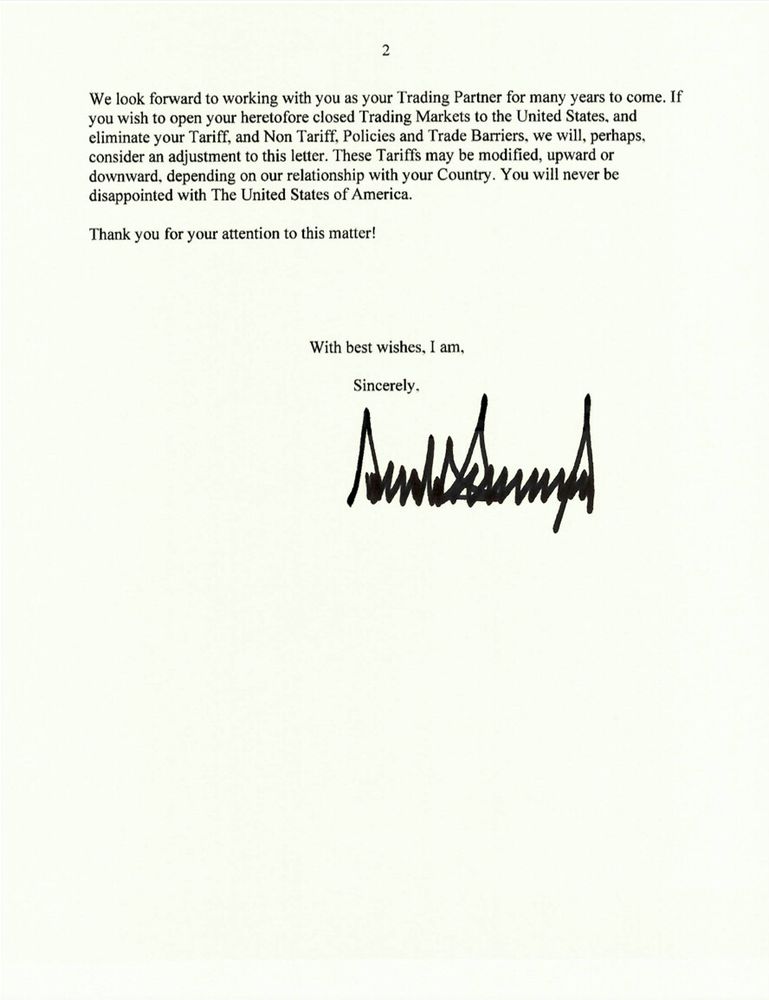

Matt Novak

@paleofuture.bsky.social

Trump is posting his tariff "letters" to various countries on Truth Social, with Japan and South Korea posted so far. He also ends the letters with "thank you for your attention to this matter!"

@paleofuture.bsky.social

Trump is posting his tariff "letters" to various countries on Truth Social, with Japan and South Korea posted so far. He also ends the letters with "thank you for your attention to this matter!"

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ponchi101

- Site Admin

- Posts: 18885

- Joined: Mon Dec 07, 2020 4:40 pm

- Location: New Macondo

- Has thanked: 4117 times

- Been thanked: 6991 times

- Contact:

Re: Business/Markets/Stocks/Economics Random, Random

What an idiotic letter.

Ego figere omnia et scio supellectilem

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Imagine being the Finance Minister of a country and getting a letter like this from the person occupying the most powerful seat in the world.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

The reaction around the world:

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

- dryrunguy

- Posts: 1967

- Joined: Thu Dec 10, 2020 6:31 am

- Has thanked: 866 times

- Been thanked: 1079 times

Re: Business/Markets/Stocks/Economics Random, Random

I wonder if anyone has ever tried to discuss proper and improper capitalization with him... Just thinking out loud...

Who is online

Users browsing this forum: No registered users and 16 guests