We are still under attack. Please read THIS, if you are interested. Sorry about this.

Business/Markets/Stocks/Economics Random, Random

-

ashkor87

- Posts: 7752

- Joined: Wed May 26, 2021 6:18 am

- Location: India

- Has thanked: 3514 times

- Been thanked: 1152 times

-

Suliso

- Posts: 5461

- Joined: Fri Dec 11, 2020 2:30 pm

- Location: Basel, Switzerland

- Has thanked: 310 times

- Been thanked: 1789 times

-

ashkor87

- Posts: 7752

- Joined: Wed May 26, 2021 6:18 am

- Location: India

- Has thanked: 3514 times

- Been thanked: 1152 times

Re: Business/Markets/Stocks/Economics Random, Random

A lazy attempt to avoid actually calculating

And it has nothing to do with tariffs..just because we have a current account deficit, doesn't mean we face trade barriers..

And it has nothing to do with tariffs..just because we have a current account deficit, doesn't mean we face trade barriers..

-

Suliso

- Posts: 5461

- Joined: Fri Dec 11, 2020 2:30 pm

- Location: Basel, Switzerland

- Has thanked: 310 times

- Been thanked: 1789 times

Re: Business/Markets/Stocks/Economics Random, Random

A Canadian colleague at work said that this would be easy for Canada to solve. Just stop selling oil to US and no more deficit and thus no more tariffs.

-

ponchi101

- Site Admin

- Posts: 18873

- Joined: Mon Dec 07, 2020 4:40 pm

- Location: New Macondo

- Has thanked: 4116 times

- Been thanked: 6990 times

- Contact:

Re: Business/Markets/Stocks/Economics Random, Random

The Canada example is telling.

Just stop selling oil to the USA. But if you do that, who do you sell it to? Storing it means bankruptcy because storage is very expensive.

So it is not as if Canada can really do that.

This is what happens when you elect idiots to be president. As I Venezuelan, I know about that.

(And as a resident of Colombia, I know about that twice).

Just stop selling oil to the USA. But if you do that, who do you sell it to? Storing it means bankruptcy because storage is very expensive.

So it is not as if Canada can really do that.

This is what happens when you elect idiots to be president. As I Venezuelan, I know about that.

(And as a resident of Colombia, I know about that twice).

Ego figere omnia et scio supellectilem

-

Suliso

- Posts: 5461

- Joined: Fri Dec 11, 2020 2:30 pm

- Location: Basel, Switzerland

- Has thanked: 310 times

- Been thanked: 1789 times

Re: Business/Markets/Stocks/Economics Random, Random

It wasn't meant seriously albeit in a medium term oil perhaps could be sold to someone else.

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Stocks fall sharply in worst day since 2020

Stocks plunge and businesses recoil after across-the-board tariffs

Other countries vowed to respond after President Donald Trump imposed higher tariffs on imports from much of the world, including many U.S. allies.

Updated

April 3, 2025 at 4:46 p

By Abha Bhattarai and Gerrit De Vynck

Donald Trump’s intensifying trade war sent financial markets reeling as investors, companies and Americans fretted about rising costs from an onslaught of new tariffs.

U.S. stocks closed down sharply Thursday, with the tech-heavy Nasdaq falling close to 6 percent for the day and about 17 percent from its mid-February peak, with Apple, Google and Nvidia all posting big losses. The S&P 500 notched its biggest one-day drop since summer of 2020, closing down 4.8 percent. The Dow Jones Industrial Average fell almost 4 percent. The major indexes in Asia and Europe also took a fall, although some recovered their losses during their trading day.

The wave of new import taxes, which are expected to cost U.S. consumers and businesses billions of dollars this year, threatens to radically alter the economic outlook. Economists on Wall Street and beyond are now warning that a downturn is becoming much more likely this year.

“The level of new tariffs is just absolutely massive,” said Luke Tilley, chief economist at Wilmington Trust, which now puts the odds of a recession at 50 percent, up from 40 percent earlier this week. “There is still so much uncertainty, but if these tariffs stay on for three months, there’ll be a recession — and that will be one of the easier calls I’ve had to make in my 25 years of being an economist.”

Major companies are already scrambling to adjust their investments and hiring to reflect a much costlier new reality. Jeep-maker Stellantis said it was temporarily laying off 900 workers at five plants in Michigan and Indiana, and pausing production at factories in Canada and Mexico, while it tries to figure out “the medium- and long-term effects of these tariffs.”

On Wednesday, Trump introduced a 10 percent tariff on all imports, which will take effect Saturday, and additional taxes that will bring the levies up to 50 percent on goods from certain countries beginning April 9. A separate 25 percent tariff on imported vehicles went into effect Thursday, starting at midnight.

White House officials have said the measures are just the beginning of ongoing negotiations, and they could quickly move higher if other countries begin ratcheting up taxes on American products.

“My advice to every country right now is, do not retaliate,” Treasury Secretary Scott Bessent told Fox News on Wednesday evening. “Sit back, take it in, let’s see how it goes. Because if you retaliate, there will be escalation. If you don’t retaliate, this is the high watermark.”

However, several world leaders promised to respond, including those in China and the European Union. Most governments held back on specific countermeasures, vowing to react with “cool and calm heads,” in the words of British Prime Minister Keir Starmer. But beneath the diplomatic restraint were anger and fears of spreading economic chaos.

“This decision, which is so unprincipled, so abrupt, so profound in its impact, calls into question what kind of partner the U.S. will be,” said Susannah Patton, director of the Southeast Asia Program at the Lowy Institute, an Australian think tank. “It will play into China’s narrative that the U.S. is an unreliable, distant partner that can come and go.”

The size of the tariffs stunned U.S. allies in particular.

“The administration’s tariffs have no basis in logic, and they go against the basis of our two nations’ partnership,” said Australian Prime Minister Anthony Albanese, whose country got off relatively lightly with a 10 percent blanket duty. “This is not the act of a friend.”

The European Union, which was hit with a 20 percent blanket tariff, is ready to respond if talks with Washington fail, said the head of the E.U. executive branch, European Commission President Ursula von der Leyen. “There seems to be no order in the disorder. No clear path through the complexity and chaos,” she said in a statement describing the tariffs as a “major blow.”

The 27-nation bloc is finalizing its first round of retaliation to U.S. steel tariffs and is “preparing for further countermeasures to protect our interests and our businesses if negotiations fail,” she said.

The tariffs are particularly onerous on China, the world’s second-biggest economy and the target of much of Trump’s ire as it ran a nearly $1 trillion trade surplus with the United States last year.

The new tariff of 34 percent on Chinese goods comes on top of the 20 percent levy already imposed as Trump accused Beijing of not doing enough to stop the flow of fentanyl and its precursors into the United States. It is also in addition to the existing tariffs on goods, including some appliances, machinery and clothing that were already as high as 45 percent.

Uncertainty is creating chaos for business owners, including many that have spent years expanding manufacturing operations in countries such as Mexico, Vietnam and India, as part of an effort to work around the tariffs Trump placed on Chinese goods during his first term. Now imports from those three countries — along with dozens others — will soon cost much more.

On Wednesday evening, small-business owner Anjali Bhargava was trying to tally up the higher costs she will face on ingredients for the turmeric and chai blends she sells at retailers such as Whole Foods. The fallout would be swift and vast, she said: a 26 percent price hike on tea from India, an extra 36 percent for turmeric from Thailand and an additional 46 percent on cinnamon and ginger from Vietnam.

“I’m honestly stunned,” said Bhargava, 48, who founded her business, Anjali’s Cup, in 2014. “I may have to just use the ingredients I’ve been able to buy and throw in the towel. But then what? [I’ve] taken on so much debt to keep things going through the pandemic and to grow.”

But some industries applauded the administration’s announcement Wednesday. The American Petroleum Institute thanked Trump for excluding oil and natural gas from the new tariffs. The American Iron and Steel Institute, which represents North American steel producers, said Trump was “standing up for American workers.”

Major labor unions said tariffs can be effective but suggested the administration still isn’t doing enough for workers. The president of United Steelworkers International said import taxes must be coupled with policies to increase domestic production and jobs, and the AFL-CIO president criticized the administration for separately attacking trade union workers’ rights.

The American Farm Bureau Federation noted that 20 percent of farm income comes from exports and warned that the president’s moves threaten farmer competitiveness in the short term and could do “longer-term damage” if other countries decide to stop buying U.S.-grown products.

“Things are kind of a train wreck in Washington right now,” said Joe Logan, a fifth-generation farmer who produces grass-fed beef in Kinsman, Ohio. “It’s really hard to imagine us getting to a stable place with anywhere the amount of funding needed to make farmers whole.”

During Trump’s first term, farmers received around $28 billion in market support to help offset the pain of tariffs. Many farmers are optimistic that the Trump administration will bail them out again this time, though Logan says he’s not as optimistic. American farmers lost significant ground during the 2018 and 2019 tariffs — particularly in soybeans, which the Chinese now obtain in greater numbers from Brazil — and never fully recovered. “Things are radically different this time,” Logan said.

The Trump administration has maintained that a period of economic turmoil is necessary to bring back manufacturing to the United States. Lopsided trade policies, the president said in an executive order, have cost the country millions of jobs and made the U.S. economy too reliant on foreign goods.

“If we’re going to make the United States a mecca of high-tech manufacturing, we have to work hand-in-hand with tariffs,” said Joseph LaVorgna, chief U.S. economist at SMBC Nikko Securities and former Trump White House economic adviser. “You need the tariff to get companies to at least consider moving to the U.S. — with no tariff, there’s no incentive for them to move.”

Just how disruptive the sweeping duties are for allies will depend on enforcement and potential exemptions, analysts said. The White House listed carve-outs for industries like semiconductors — crucial for artificial intelligence development and high-performance computing — and pharmaceuticals that may provide relief for partners such as Taiwan and South Korea.

Despite the exemption, semiconductor stocks saw notable losses early, including declines of more than 5 percent for AI and 3D-graphics chipmaker Nvidia and more than 7 percent for Taiwan Semiconductor Manufacturing Co., the world’s largest contract manufacturer of chips.

Big Tech stocks were devastated by the market sell-off, with the tech-focused Nasdaq down over 5 percent. Google fell 3 percent, Apple fell 9 percent and AI computer chip maker Nvidia fell 7 percent. The companies and their senior executives, many of which have courted the Trump administration, have stayed silent. Spokespeople for Google, Amazon, chipmaker Nvidia, Apple and Microsoft all declined to comment.

But lobbying groups that represent the tech industry broadly, including those companies, have spoken out fiercely against the tariffs.

Ed Brzytwa, vice president of international trade for the Consumer Technology Association, said electronics manufacturers are “freaking out” about the tariff hit to their products, many of which are made in China, Vietnam and other countries subject to significantly higher import taxes. “What got announced yesterday exceeded my worst case scenario expectations,” he said.

The tariffs could also impact the United States’ lead in the race to develop more capable artificial intelligence technology. AI requires huge warehouses of computer chips in order to run. Though the chips themselves aren’t being affected by tariffs, other technological components needed to run the data centers are being targeted. And the infrastructure needed to supply the energy to run AI could be hit too.

“Data centers, for example, are built with steel,” Murphy said. “There is a cascading and very broad impact, not just in the tech sector but across the broader economy.”

Companies that make many of their products overseas also saw steep drops in their stock prices on Thursday. Shares of Nike and American Eagle Outfitters, which have factories in Vietnam fell 13 percent and 19 percent, respectively, on Thursday. Good from Vietnam will face a 46 percent tariff starting next week.

Analysts said the upheaval in financial markets was likely to cause panicked Americans to pull back on purchases. Consumer spending, which makes up about 70 percent of the U.S. economy, has already been slowing in recent months, in large part because families have been skittish about tariff-related price increases.

“We already have warning signs across the economy — businesses are paralyzed, consumer sentiment is down, and people aren’t spending as much even though there’s been good income growth,” said Douglas Holtz-Eakin, president of the conservative American Action Forum. “If these tariffs are kept in place, which is a big ‘if,' they’ll reshape the economy.”

Shannon Najmabadi, Shira Ovide, Aaron Gregg and Annie Gowen contributed to this report. Christian Shepherd and Rebecca Tan contributed reporting from Singapore, as did Steve Hendrix in London, Chie Tanakant in Tokyo, Lyric Li in Seoul, Kate Brady in Berlin and Ellen Francis and Beatriz Ríos in Brussels.

https://www.washingtonpost.com/business ... ck-market/

Stocks plunge and businesses recoil after across-the-board tariffs

Other countries vowed to respond after President Donald Trump imposed higher tariffs on imports from much of the world, including many U.S. allies.

Updated

April 3, 2025 at 4:46 p

By Abha Bhattarai and Gerrit De Vynck

Donald Trump’s intensifying trade war sent financial markets reeling as investors, companies and Americans fretted about rising costs from an onslaught of new tariffs.

U.S. stocks closed down sharply Thursday, with the tech-heavy Nasdaq falling close to 6 percent for the day and about 17 percent from its mid-February peak, with Apple, Google and Nvidia all posting big losses. The S&P 500 notched its biggest one-day drop since summer of 2020, closing down 4.8 percent. The Dow Jones Industrial Average fell almost 4 percent. The major indexes in Asia and Europe also took a fall, although some recovered their losses during their trading day.

The wave of new import taxes, which are expected to cost U.S. consumers and businesses billions of dollars this year, threatens to radically alter the economic outlook. Economists on Wall Street and beyond are now warning that a downturn is becoming much more likely this year.

“The level of new tariffs is just absolutely massive,” said Luke Tilley, chief economist at Wilmington Trust, which now puts the odds of a recession at 50 percent, up from 40 percent earlier this week. “There is still so much uncertainty, but if these tariffs stay on for three months, there’ll be a recession — and that will be one of the easier calls I’ve had to make in my 25 years of being an economist.”

Major companies are already scrambling to adjust their investments and hiring to reflect a much costlier new reality. Jeep-maker Stellantis said it was temporarily laying off 900 workers at five plants in Michigan and Indiana, and pausing production at factories in Canada and Mexico, while it tries to figure out “the medium- and long-term effects of these tariffs.”

On Wednesday, Trump introduced a 10 percent tariff on all imports, which will take effect Saturday, and additional taxes that will bring the levies up to 50 percent on goods from certain countries beginning April 9. A separate 25 percent tariff on imported vehicles went into effect Thursday, starting at midnight.

White House officials have said the measures are just the beginning of ongoing negotiations, and they could quickly move higher if other countries begin ratcheting up taxes on American products.

“My advice to every country right now is, do not retaliate,” Treasury Secretary Scott Bessent told Fox News on Wednesday evening. “Sit back, take it in, let’s see how it goes. Because if you retaliate, there will be escalation. If you don’t retaliate, this is the high watermark.”

However, several world leaders promised to respond, including those in China and the European Union. Most governments held back on specific countermeasures, vowing to react with “cool and calm heads,” in the words of British Prime Minister Keir Starmer. But beneath the diplomatic restraint were anger and fears of spreading economic chaos.

“This decision, which is so unprincipled, so abrupt, so profound in its impact, calls into question what kind of partner the U.S. will be,” said Susannah Patton, director of the Southeast Asia Program at the Lowy Institute, an Australian think tank. “It will play into China’s narrative that the U.S. is an unreliable, distant partner that can come and go.”

The size of the tariffs stunned U.S. allies in particular.

“The administration’s tariffs have no basis in logic, and they go against the basis of our two nations’ partnership,” said Australian Prime Minister Anthony Albanese, whose country got off relatively lightly with a 10 percent blanket duty. “This is not the act of a friend.”

The European Union, which was hit with a 20 percent blanket tariff, is ready to respond if talks with Washington fail, said the head of the E.U. executive branch, European Commission President Ursula von der Leyen. “There seems to be no order in the disorder. No clear path through the complexity and chaos,” she said in a statement describing the tariffs as a “major blow.”

The 27-nation bloc is finalizing its first round of retaliation to U.S. steel tariffs and is “preparing for further countermeasures to protect our interests and our businesses if negotiations fail,” she said.

The tariffs are particularly onerous on China, the world’s second-biggest economy and the target of much of Trump’s ire as it ran a nearly $1 trillion trade surplus with the United States last year.

The new tariff of 34 percent on Chinese goods comes on top of the 20 percent levy already imposed as Trump accused Beijing of not doing enough to stop the flow of fentanyl and its precursors into the United States. It is also in addition to the existing tariffs on goods, including some appliances, machinery and clothing that were already as high as 45 percent.

Uncertainty is creating chaos for business owners, including many that have spent years expanding manufacturing operations in countries such as Mexico, Vietnam and India, as part of an effort to work around the tariffs Trump placed on Chinese goods during his first term. Now imports from those three countries — along with dozens others — will soon cost much more.

On Wednesday evening, small-business owner Anjali Bhargava was trying to tally up the higher costs she will face on ingredients for the turmeric and chai blends she sells at retailers such as Whole Foods. The fallout would be swift and vast, she said: a 26 percent price hike on tea from India, an extra 36 percent for turmeric from Thailand and an additional 46 percent on cinnamon and ginger from Vietnam.

“I’m honestly stunned,” said Bhargava, 48, who founded her business, Anjali’s Cup, in 2014. “I may have to just use the ingredients I’ve been able to buy and throw in the towel. But then what? [I’ve] taken on so much debt to keep things going through the pandemic and to grow.”

But some industries applauded the administration’s announcement Wednesday. The American Petroleum Institute thanked Trump for excluding oil and natural gas from the new tariffs. The American Iron and Steel Institute, which represents North American steel producers, said Trump was “standing up for American workers.”

Major labor unions said tariffs can be effective but suggested the administration still isn’t doing enough for workers. The president of United Steelworkers International said import taxes must be coupled with policies to increase domestic production and jobs, and the AFL-CIO president criticized the administration for separately attacking trade union workers’ rights.

The American Farm Bureau Federation noted that 20 percent of farm income comes from exports and warned that the president’s moves threaten farmer competitiveness in the short term and could do “longer-term damage” if other countries decide to stop buying U.S.-grown products.

“Things are kind of a train wreck in Washington right now,” said Joe Logan, a fifth-generation farmer who produces grass-fed beef in Kinsman, Ohio. “It’s really hard to imagine us getting to a stable place with anywhere the amount of funding needed to make farmers whole.”

During Trump’s first term, farmers received around $28 billion in market support to help offset the pain of tariffs. Many farmers are optimistic that the Trump administration will bail them out again this time, though Logan says he’s not as optimistic. American farmers lost significant ground during the 2018 and 2019 tariffs — particularly in soybeans, which the Chinese now obtain in greater numbers from Brazil — and never fully recovered. “Things are radically different this time,” Logan said.

The Trump administration has maintained that a period of economic turmoil is necessary to bring back manufacturing to the United States. Lopsided trade policies, the president said in an executive order, have cost the country millions of jobs and made the U.S. economy too reliant on foreign goods.

“If we’re going to make the United States a mecca of high-tech manufacturing, we have to work hand-in-hand with tariffs,” said Joseph LaVorgna, chief U.S. economist at SMBC Nikko Securities and former Trump White House economic adviser. “You need the tariff to get companies to at least consider moving to the U.S. — with no tariff, there’s no incentive for them to move.”

Just how disruptive the sweeping duties are for allies will depend on enforcement and potential exemptions, analysts said. The White House listed carve-outs for industries like semiconductors — crucial for artificial intelligence development and high-performance computing — and pharmaceuticals that may provide relief for partners such as Taiwan and South Korea.

Despite the exemption, semiconductor stocks saw notable losses early, including declines of more than 5 percent for AI and 3D-graphics chipmaker Nvidia and more than 7 percent for Taiwan Semiconductor Manufacturing Co., the world’s largest contract manufacturer of chips.

Big Tech stocks were devastated by the market sell-off, with the tech-focused Nasdaq down over 5 percent. Google fell 3 percent, Apple fell 9 percent and AI computer chip maker Nvidia fell 7 percent. The companies and their senior executives, many of which have courted the Trump administration, have stayed silent. Spokespeople for Google, Amazon, chipmaker Nvidia, Apple and Microsoft all declined to comment.

But lobbying groups that represent the tech industry broadly, including those companies, have spoken out fiercely against the tariffs.

Ed Brzytwa, vice president of international trade for the Consumer Technology Association, said electronics manufacturers are “freaking out” about the tariff hit to their products, many of which are made in China, Vietnam and other countries subject to significantly higher import taxes. “What got announced yesterday exceeded my worst case scenario expectations,” he said.

The tariffs could also impact the United States’ lead in the race to develop more capable artificial intelligence technology. AI requires huge warehouses of computer chips in order to run. Though the chips themselves aren’t being affected by tariffs, other technological components needed to run the data centers are being targeted. And the infrastructure needed to supply the energy to run AI could be hit too.

“Data centers, for example, are built with steel,” Murphy said. “There is a cascading and very broad impact, not just in the tech sector but across the broader economy.”

Companies that make many of their products overseas also saw steep drops in their stock prices on Thursday. Shares of Nike and American Eagle Outfitters, which have factories in Vietnam fell 13 percent and 19 percent, respectively, on Thursday. Good from Vietnam will face a 46 percent tariff starting next week.

Analysts said the upheaval in financial markets was likely to cause panicked Americans to pull back on purchases. Consumer spending, which makes up about 70 percent of the U.S. economy, has already been slowing in recent months, in large part because families have been skittish about tariff-related price increases.

“We already have warning signs across the economy — businesses are paralyzed, consumer sentiment is down, and people aren’t spending as much even though there’s been good income growth,” said Douglas Holtz-Eakin, president of the conservative American Action Forum. “If these tariffs are kept in place, which is a big ‘if,' they’ll reshape the economy.”

Shannon Najmabadi, Shira Ovide, Aaron Gregg and Annie Gowen contributed to this report. Christian Shepherd and Rebecca Tan contributed reporting from Singapore, as did Steve Hendrix in London, Chie Tanakant in Tokyo, Lyric Li in Seoul, Kate Brady in Berlin and Ellen Francis and Beatriz Ríos in Brussels.

https://www.washingtonpost.com/business ... ck-market/

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Trump tariff live updates: President says he’s open to negotiations, contradicting White House aides

Dan Mangan

Kevin Breuninger

Christina Wilkie

Michele Luhn

This is CNBC’s live coverage of how U.S. trade partners, industries and employers are responding to President Donald Trump’s new tariffs.

https://www.cnbc.com/2025/04/03/trump-t ... e-war.html

Dan Mangan

Kevin Breuninger

Christina Wilkie

Michele Luhn

This is CNBC’s live coverage of how U.S. trade partners, industries and employers are responding to President Donald Trump’s new tariffs.

https://www.cnbc.com/2025/04/03/trump-t ... e-war.html

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Treasury Secretary urges other countries to 'take a deep breath' and not retaliate

https://www.cnn.com/2025/04/02/politics ... ntv-digvid

Video

https://www.cnn.com/2025/04/02/politics ... ntv-digvid

Video

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Carl Quintanilla @carlquintanilla.bsky.social

·

29m

“If Harris wins this election, the result will be a Kamala economic crash. .. A 1929-style depression. When I win the election, we will immediately begin a brand new Trump economic boom.”

- Trump, 8/14/24

·

29m

“If Harris wins this election, the result will be a Kamala economic crash. .. A 1929-style depression. When I win the election, we will immediately begin a brand new Trump economic boom.”

- Trump, 8/14/24

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

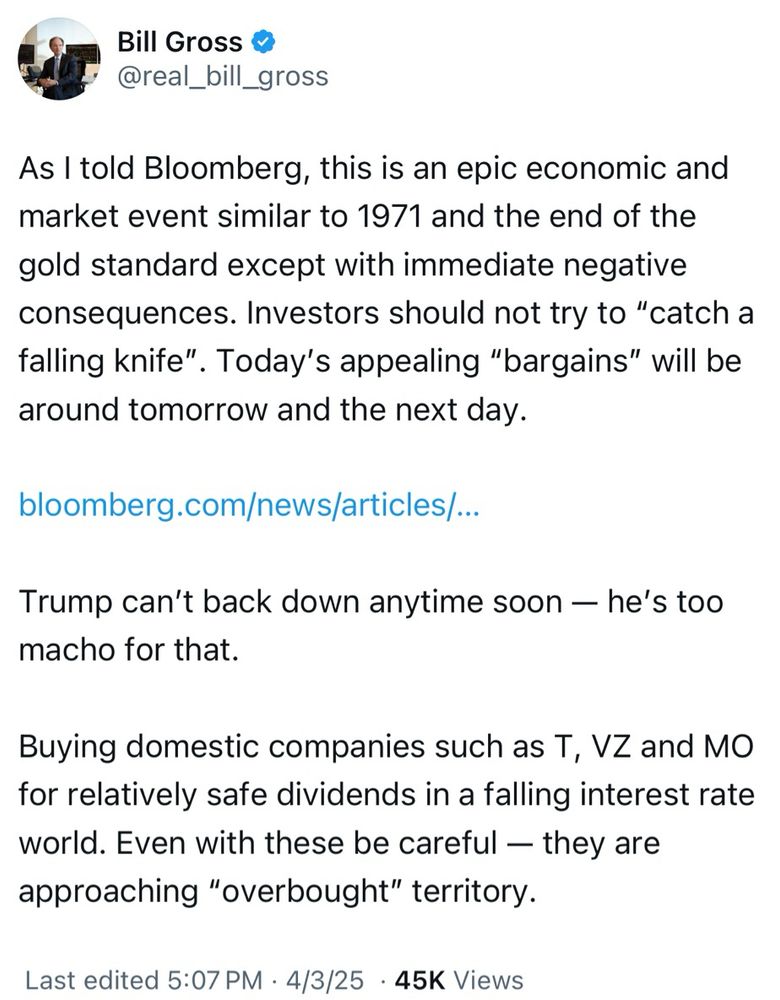

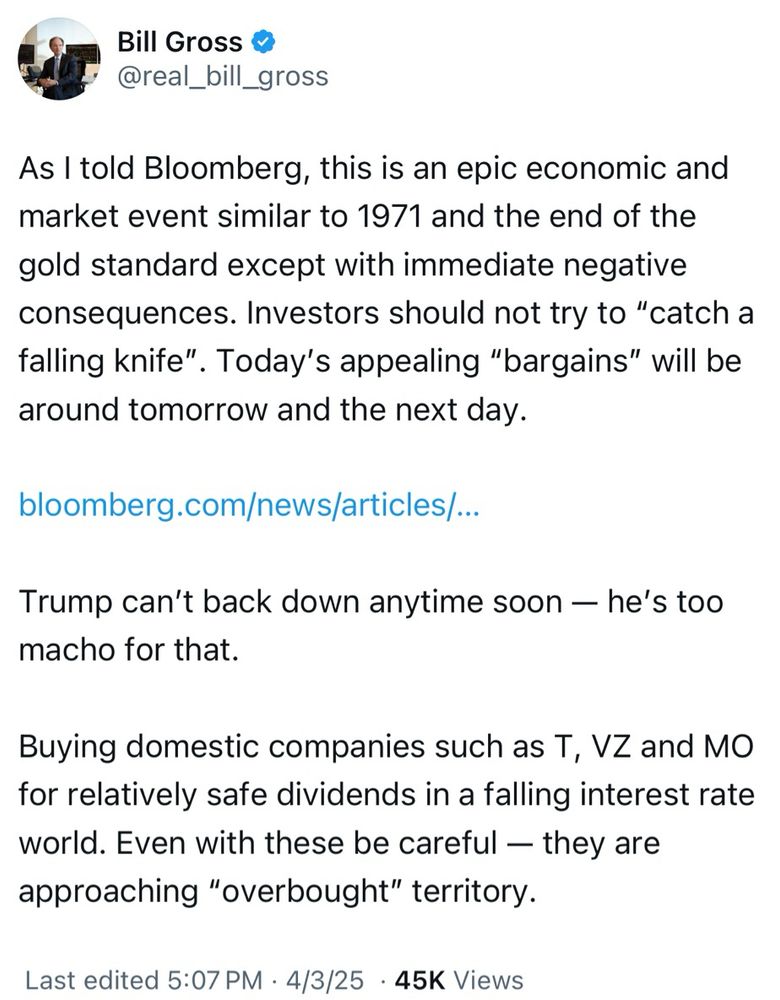

Carl Quintanilla @carlquintanilla.bsky.social

·

38m

BILL GROSS: “.. Investors should not try to ‘catch a falling knife’ .. Trump can’t back down anytime soon — he’s too macho for that.”

·

38m

BILL GROSS: “.. Investors should not try to ‘catch a falling knife’ .. Trump can’t back down anytime soon — he’s too macho for that.”

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Robin Wigglesworth

@robinwigglesworth.ft.com

Follow

Well, JPMorgan’s chief economist Bruce Kasman certainly sounds cheery.

@robinwigglesworth.ft.com

Follow

Well, JPMorgan’s chief economist Bruce Kasman certainly sounds cheery.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

It's been just a little over two months...Carney - ''The global economy is fundamentally different today than it was yesterday. The system of global trade anchored on the United States is over. The 80 year period when the United States embraced the mantle of economic leadership is over. While this is a tragedy, it is also the new reality.''

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32041

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6191 times

- Been thanked: 4203 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Current

SYMBOL PRICE CHANGE %CHANGE

DJIA

39,098.41 -1,447.52 -3.57

NASDAQ

15,781.33 -769.28 -4.65

S&P 500

5,165.14 -231.38 -4.29

https://www.cnbc.com/us-markets/

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

Who is online

Users browsing this forum: Semrush [Bot] and 72 guests