Business/Markets/Stocks/Economics Random, Random

- dryrunguy

- Posts: 2059

- Joined: Thu Dec 10, 2020 6:31 am

- Has thanked: 975 times

- Been thanked: 1153 times

Re: Business/Markets/Stocks/Economics Random, Random

One in nine jobs in the Los Angeles area are tied directly or indirectly to the area's ports? I had no idea.

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Short-term debt issued by corporations surged in April as companies sought to bolster their liquidity in the wake of economic uncertainty wrought by the Trump Administration’s tariff policies, according to strategists at JPMorgan Chase & Co.

Issuance of non-financial commercial paper swelled by $100 billion last month, which is above the monthly average of $27 billion seen from 2019 to 2024, excluding 2020, JPMorgan strategists led by Teresa Ho wrote in a note to clients on Friday, citing data from the Depository Trust & Clearing Corporation. At its peak, the gap between the highest-rated paper — known as Tier 1 — and T-bills stood at the widest level since August 2022. The spread to less credit-worthy paper — known as Tier 2 — reached its widest level since June 2023.

“Anecdotally, it appears companies are raising cash as a precautionary measure in response to the heightened uncertainty following Liberation Day,” they wrote.

The Trump Administration’s tariff announcement on April 2 unleashed turmoil in the financial markets, with the S&P 500 losing more than 10% in two sessions. The benchmark index reversed course a week later, when the White House delayed most of the duties for 90 days, with the exception of tariffs on China. The uncertainty also caused Treasury yields to soar and sparked a rush for cash.

Corporations are bolstering cash positions due to economic uncertainty spearheaded by Tariffs.

Source: https://finance.yahoo.com/news/companie ... 04436.html

These were my thoughts when Bezos publicly announced he was selling a huge amount of shares. If the rush is to liquidity then we'd all better buckle our seatbelts.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

President Xi Jinping will use his state visit to Moscow this week to showcase his tight ties with Russian counterpart Vladimir Putin, and capitalize on a trade war that’s isolating Washington.

“Key on the agenda is what kind of opportunities there are, and how to coordinate Russia’s and Chinese actions to use these four years to undo the US hegemony,” said Alexander Gabuev, director of the Carnegie Russia Eurasia Center. The two men will want to “help Trump to destroy American supremacy and arrive at a multipolar world order where Russia and China can thrive.”

Source: https://finance.yahoo.com/news/xi-heads ... 12489.html

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Trump Accidentally Admits He Hasn’t Made Any Trade Deals

Donald Trump has continually insisted that deals over his tariffs are coming.

Donald Trump claimed Tuesday that the U.S. doesn’t “have to sign” any trade deals, inadvertently admitting that his administration hasn’t made any progress during the 90-day pause on his disastrous tariffs.

During a tense meeting to discuss tariffs with Canadian Prime Minister Mark Carney, the president attempted to move the goal posts on actually completing any agreements with foreign countries.

“Everyone says, ‘When, when, when, are you going to sign deals?’ We don’t have to sign deals!” Trump said.

“We don’t have to sign deals. They have to sign deals with us. They want a piece of our market, we don’t want a piece of their market. We don’t care about their market. They want a piece of our market,” Trump rambled.

The president’s unwieldy statements downplaying the importance of the trade deals seemed to be cushioning the likelihood that negotiations would ultimately fail. Trump’s remarks also revealed that his administration has yet to complete a single trade deal.

Last month, Trump claimed to have already struck 200 trade agreements with foreign countries, a remark so outlandish it sent members of his administration scrambling to make it make sense. (There are also only 195 countries in the world.)

Instead of pledging to sign deals, Trump presented his own plan Tuesday. The president claimed that “at some point over the next two weeks,” he intended to sit down with members of his Cabinet and offer individualized deals to each country seeking tariff relief.

“We’re gonna say, ‘Here’s what this country—what we want, and congratulations we have a deal!’ And they’ll either say ‘Great,’ and they’ll start shopping, or they’ll say, ‘Not good, we’re not gonna do it,’” Trump said.

Trump claimed that the offers would include “very fair numbers,” but that they might also include other requests. He also said that his administration would be open to adjusting the deals based on how the countries responded.

“And then you people will say, ‘Oh it’s so chaotic,’ no, we’re flexible,” Trump said, referring to the press.

In any case, Trump continued to emphasize that his goal wasn’t actually to make deals, just to put out offers. “In some cases we’ll sign some deals, it’s much less important than what I’m talking about,” he said. He warned that in one day, he could present 100 offers, but “they don’t have to sign.”

Still, Trump said he wanted countries to “pay for the privilege of being able to shop in the United States of America.”

https://newrepublic.com/post/194920/don ... rade-deals

Donald Trump has continually insisted that deals over his tariffs are coming.

Donald Trump claimed Tuesday that the U.S. doesn’t “have to sign” any trade deals, inadvertently admitting that his administration hasn’t made any progress during the 90-day pause on his disastrous tariffs.

During a tense meeting to discuss tariffs with Canadian Prime Minister Mark Carney, the president attempted to move the goal posts on actually completing any agreements with foreign countries.

“Everyone says, ‘When, when, when, are you going to sign deals?’ We don’t have to sign deals!” Trump said.

“We don’t have to sign deals. They have to sign deals with us. They want a piece of our market, we don’t want a piece of their market. We don’t care about their market. They want a piece of our market,” Trump rambled.

The president’s unwieldy statements downplaying the importance of the trade deals seemed to be cushioning the likelihood that negotiations would ultimately fail. Trump’s remarks also revealed that his administration has yet to complete a single trade deal.

Last month, Trump claimed to have already struck 200 trade agreements with foreign countries, a remark so outlandish it sent members of his administration scrambling to make it make sense. (There are also only 195 countries in the world.)

Instead of pledging to sign deals, Trump presented his own plan Tuesday. The president claimed that “at some point over the next two weeks,” he intended to sit down with members of his Cabinet and offer individualized deals to each country seeking tariff relief.

“We’re gonna say, ‘Here’s what this country—what we want, and congratulations we have a deal!’ And they’ll either say ‘Great,’ and they’ll start shopping, or they’ll say, ‘Not good, we’re not gonna do it,’” Trump said.

Trump claimed that the offers would include “very fair numbers,” but that they might also include other requests. He also said that his administration would be open to adjusting the deals based on how the countries responded.

“And then you people will say, ‘Oh it’s so chaotic,’ no, we’re flexible,” Trump said, referring to the press.

In any case, Trump continued to emphasize that his goal wasn’t actually to make deals, just to put out offers. “In some cases we’ll sign some deals, it’s much less important than what I’m talking about,” he said. He warned that in one day, he could present 100 offers, but “they don’t have to sign.”

Still, Trump said he wanted countries to “pay for the privilege of being able to shop in the United States of America.”

https://newrepublic.com/post/194920/don ... rade-deals

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Carl Quintanilla

@carlquintanilla.bsky.social

· 1h

INBOX: “.. While in Switzerland, Secretary Bessent will also meet with the lead representative on economic matters from the People’s Republic of China (PRC).

home.treasury.gov/news/press-r...

@carlquintanilla.bsky.social

· 1h

INBOX: “.. While in Switzerland, Secretary Bessent will also meet with the lead representative on economic matters from the People’s Republic of China (PRC).

home.treasury.gov/news/press-r...

Going live with my meta glasses

@mustache-era.bsky.social

Follow

As they can customize headlines about the “dealmaking” process, the Chinese now have full control of the US stock market. As if they needed more leverage points.

Kimbell’s Mowgli @kimbellsmowgli.bsky.social

· 37m

And Japan has the bond market. Great job Donald.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

The Chinese

US right now

US right now

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Kevin M. Kruse

@kevinmkruse.bsky.social

· 2m

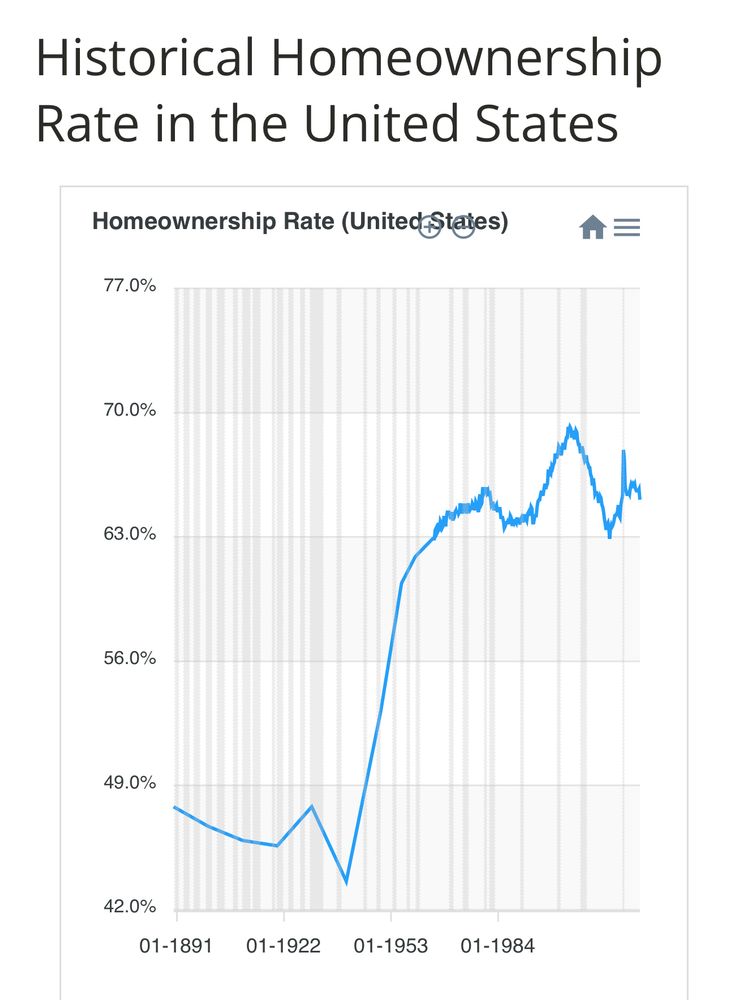

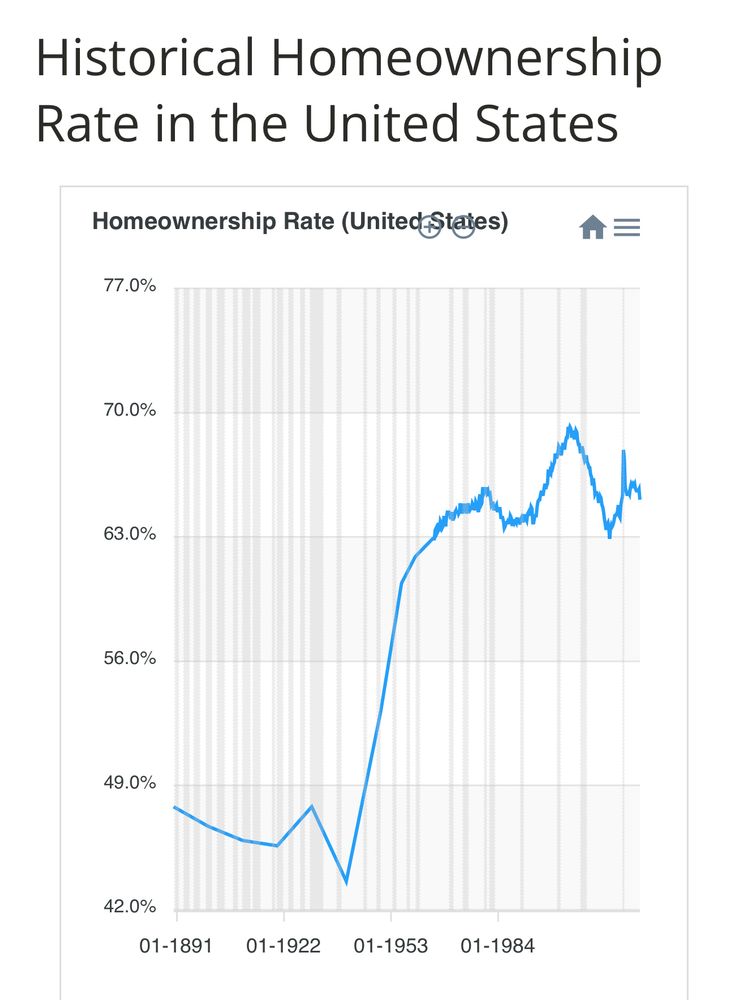

Now they’re claiming that tariffs will lead to a surge in home ownership?

It’s simplistic, but they keep harkening back to 1890-1913 as the golden age they’ll recreate. Let’s take a look …

@kevinmkruse.bsky.social

· 2m

Now they’re claiming that tariffs will lead to a surge in home ownership?

It’s simplistic, but they keep harkening back to 1890-1913 as the golden age they’ll recreate. Let’s take a look …

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Joey Politano

@josephpolitano.bsky.social

· 3h

This is genuinely insane

@josephpolitano.bsky.social

· 3h

This is genuinely insane

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

With Trump back in office imposing blanket tariffs on all U.S. trading partners, global trade is seizing up fast. Instead of boosting American industry, these tariffs act like a tax hike on consumers and businesses, while retaliation from abroad crushes U.S. exports. Don’t believe me? Look up the total net goods The US imported in Q1 and then watch what that number is in Q2… if it’s anything like the collapse of imports from China that has been steadily dropping since end of April…

Meanwhile, a 2020 style oil shock where crude prices collapse into negative territory again due to oversupply and a global demand slump is also on the cards and will decimate the energy sector. Normally cheap oil helps, but not when it bankrupts U.S. shale, kills transport jobs, and signals a collapse in real economic activity.

The Fed is cornered. Inflation metrics fall, but only because energy prices crash… not because the economy is healthy. With rising unemployment (although not rising fast enough for Fed to act in it due to Baby Boomers and Gen X retiring en masse), weak demand, and a dislocated bond market, Powell’s hands are tied. If the U.S. receives a major credit downgrade (as seems likely with exploding deficits and falling Treasury demand), long-term yields could spike even as the Fed tries to cut. Eventually, the Fed will be forced into permanent QE and yield curve control… monetizing debt just to keep the system functioning. By then, inflation returns, not from overheating, but from a collapsing dollar and evaporating trust.

This is stagflation with a geopolitical twist. China, quietly in a recession of its own, will lash out economically or militarily. BRICS nations push harder for de-dollarization. U.S. allies may begin hedging away from Washington. The result? Gold over $3,000, the S&P down 50%, real GDP down 6-8%, and a long period of structural decline… where monetary policy dies, foreign capital flees, and the dollar loses its unipolar dominance.

The Fed isn’t behind the curve… they’ve lost the playbook. And the world knows it.

P1/2

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Sources for above:

Penn Wharton Budget Model. (2025, April 10). The economic effects of President Trump’s tariffs. University of Pennsylvania. Retrieved from https://budgetmodel.wharton.upenn.edu/i ... ps-tariffs

2. Peter G. Peterson Foundation. (2023, November 11). Moody’s lowers U.S. credit rating outlook to negative, citing large federal deficits. Retrieved from https://www.pgpf.org/article/moodys-low ... l-deficits

3. Fitch Ratings. (2023, August 1). Fitch downgrades United States’ long-term ratings to ‘AA+’ from ‘AAA’; outlook stable. Retrieved from https://www.fitchratings.com/research/s ... 01-08-2023

4. Reuters. (2025, May 8). Trade tensions push global recession risks higher - graphic. Retrieved from https://www.reuters.com/markets/global- ... 2025-05-08

5. National Public Radio (NPR). (2025, April 30). U.S. economy shrinks as Trump tariffs spark recession fears. Retrieved from https://www.npr.org/2025/04/30/nx-s1-53 ... -consumers[/quote]

Penn Wharton Budget Model. (2025, April 10). The economic effects of President Trump’s tariffs. University of Pennsylvania. Retrieved from https://budgetmodel.wharton.upenn.edu/i ... ps-tariffs

2. Peter G. Peterson Foundation. (2023, November 11). Moody’s lowers U.S. credit rating outlook to negative, citing large federal deficits. Retrieved from https://www.pgpf.org/article/moodys-low ... l-deficits

3. Fitch Ratings. (2023, August 1). Fitch downgrades United States’ long-term ratings to ‘AA+’ from ‘AAA’; outlook stable. Retrieved from https://www.fitchratings.com/research/s ... 01-08-2023

4. Reuters. (2025, May 8). Trade tensions push global recession risks higher - graphic. Retrieved from https://www.reuters.com/markets/global- ... 2025-05-08

5. National Public Radio (NPR). (2025, April 30). U.S. economy shrinks as Trump tariffs spark recession fears. Retrieved from https://www.npr.org/2025/04/30/nx-s1-53 ... -consumers[/quote]

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Port Chief Warns Of Potential Product Shortages

By Hugh Cameron

U.S. News Reporter

Trust Project Icon

Newsweek Is A Trust Project Member

Another shipping port official voiced concern about the drastic decline in imports as a result of President Donald Trump's tariffs.

"I can see it right over my shoulder here, I'm looking out at the Port of Seattle right now, and we currently have no container ships at berth," Seattle port commissioner Ryan Calkins told CNN on Wednesday.

"That happens every once in a while at normal times, but it's pretty rare," he added. "And so to see it tonight is I think a stark reminder that the impacts of the tariffs have real implications."

Newsweek has reached out to the Port of Seattle via email outside of business hours for further comment.

Why It Matters

Several port authorities have observed a similar drop in cargo volumes over the past few weeks, warning that such a decline could have significant and adverse effects on consumers—who may face rising prices and limited product availability—as well as the supply chain-linked sectors of the U.S. economy.

What To Know

Calkins told CNN that the current situation would impact the job security of longshoremen and those dealing directly with the freight, as well as industries responsible for transporting imports nationwide.

"And that's hundreds of jobs right here in our region and across the country," he said, adding that his port had not witnessed such a significant downturn in activity since the height of the COVID-19 pandemic.

Long Beach Port CEO Mario Cordero similarly compared the current decline in traffic to COVID-era disruptions, describing the situation as "dire" in an interview with NBC.

"You could hear a pin drop," Port of Los Angeles Director Gene Seroka said, telling NPR this week that imports at the ordinarily busy port were down by around 35 percent on an annual basis.

"The impact the Port of Los Angeles has on the city, the region and the country cannot be understated," Seroka told NPR. "The cargo that moves through this port reaches not only all 50 states, but each one of our 435 congressional districts."

What People Are Saying

Gene Seroka, executive director of the Port of Los Angeles, told CNN on Tuesday: "This week, we're down about 35 percent compared to the same time last year, and these cargo ships coming in are the first ones to be attached to the tariffs that were levied against China and other locations last month. That's why the cargo volume is so light."

Seroka said last week: "American importers, especially in the retail sector, are telling me that they have about five to seven weeks of normal inventory on hand today."

Ryan Young, senior economist at the Competitive Enterprise Institute, previously told Newsweek: "Tariff-related shipping slowdowns will cause a regional cascade effect in the U.S., a little like when COVID-19 first hit. It will first be visible in West Coast ports, which have the fastest shipping times from Asia. After that it will spread to Gulf ports like Houston, which take a little longer to reach, then East Coast ports from the Carolinas up to New England."

https://www.newsweek.com/seattle-port-s ... fs-2069464

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Robin Brooks

@robin-j-brooks.bsky.social

Follow

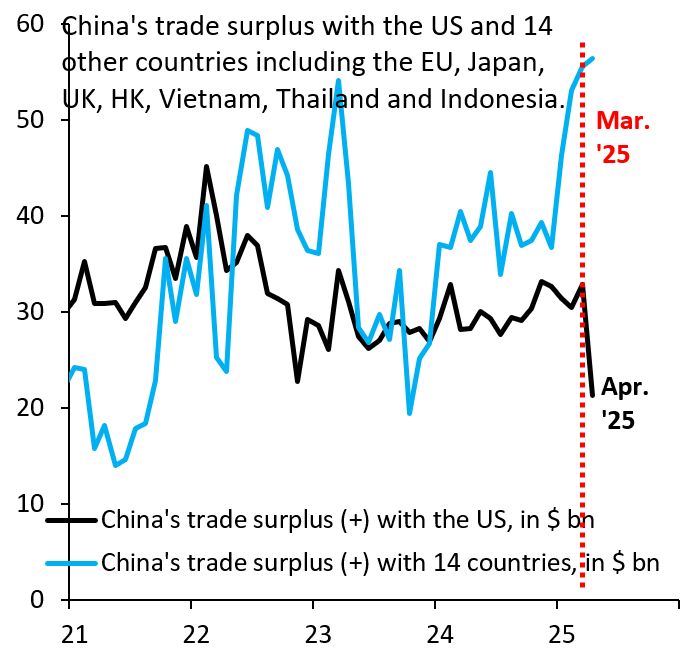

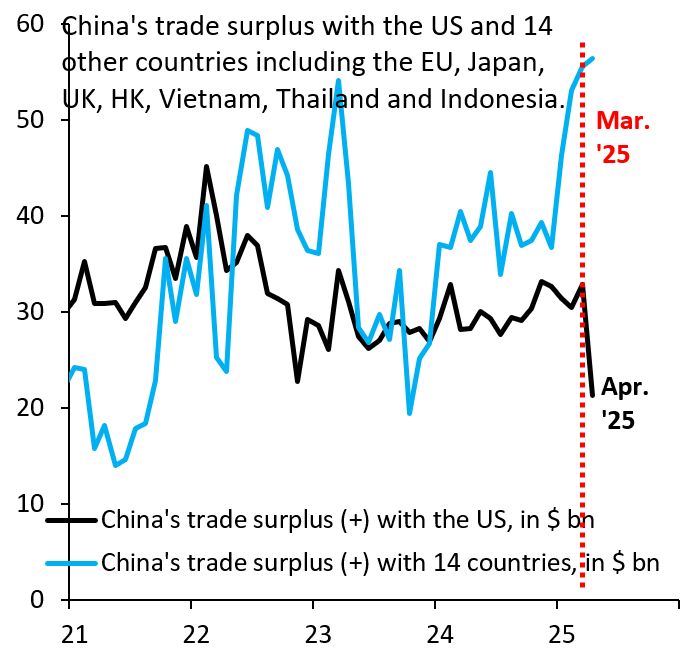

China saw US tariffs coming. China's trade surplus with the US collapsed in Apr. '25 (black), but its surplus with others began rising in Jan. '25, which more than offsets that fall (blue). US tariffs trapped a wall of goods in China that need to get out. Those goods are definitely getting out...

@robin-j-brooks.bsky.social

Follow

China saw US tariffs coming. China's trade surplus with the US collapsed in Apr. '25 (black), but its surplus with others began rising in Jan. '25, which more than offsets that fall (blue). US tariffs trapped a wall of goods in China that need to get out. Those goods are definitely getting out...

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Carl Quintanilla

@carlquintanilla.bsky.social

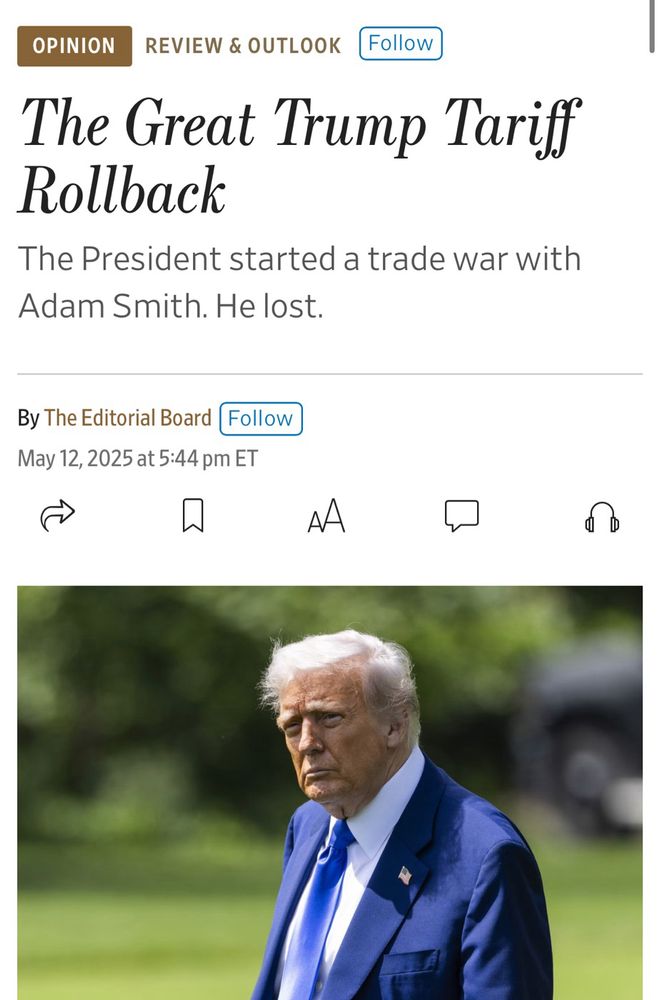

WSJ EDITORIAL BOARD: “.. Rarely has an economic policy been repudiated as soundly, and as quickly, as President Trump’s Liberation Day tariffs ..”

@wsj.com

www.wsj.com/opinion/u-s-...

@carlquintanilla.bsky.social

WSJ EDITORIAL BOARD: “.. Rarely has an economic policy been repudiated as soundly, and as quickly, as President Trump’s Liberation Day tariffs ..”

@wsj.com

www.wsj.com/opinion/u-s-...

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Just another Bill

@justabillwaiting.bsky.social

· 22m

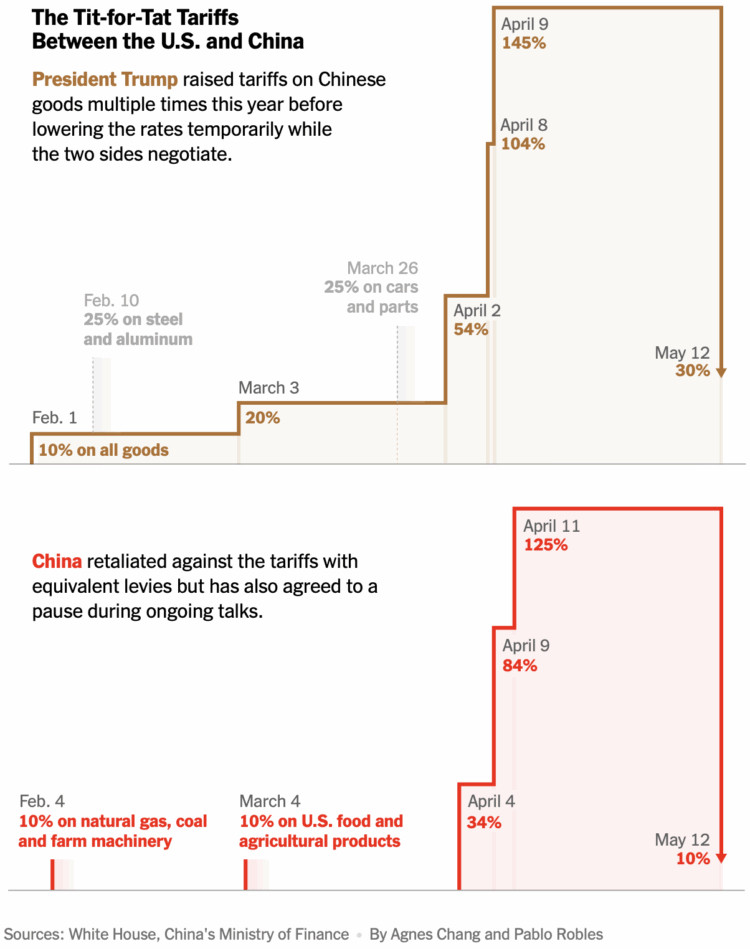

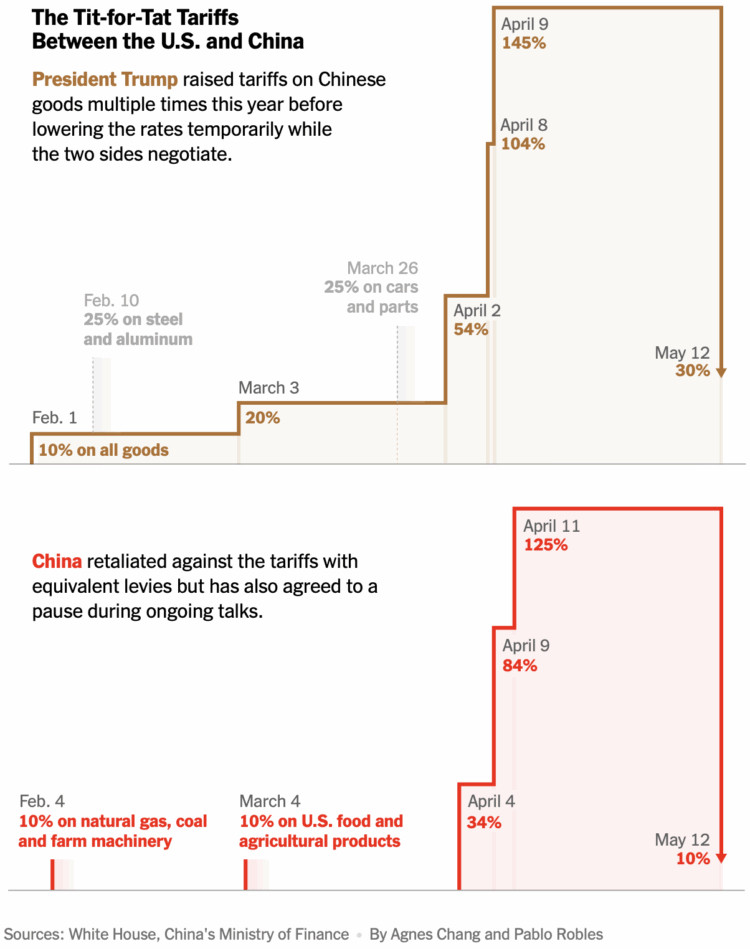

Wait? How’s this a win?

@justabillwaiting.bsky.social

· 22m

Wait? How’s this a win?

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 32981

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6210 times

- Been thanked: 4306 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Carl Quintanilla

@carlquintanilla.bsky.social

JPMORGAN: “.. The trade war shock is still material. .. we now estimate an effective ex-ante tariff rate of 14.4%. This is akin to a $475bn tax hike on US households and businesses, worth 1.6% of GDP (still sitting close to the largest tax hike in the post WWII period).”

@carlquintanilla.bsky.social

JPMORGAN: “.. The trade war shock is still material. .. we now estimate an effective ex-ante tariff rate of 14.4%. This is akin to a $475bn tax hike on US households and businesses, worth 1.6% of GDP (still sitting close to the largest tax hike in the post WWII period).”

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

Who is online

Users browsing this forum: No registered users and 1 guest