Re: Business/Markets/Stocks/Economics Random, Random

Posted: Sun May 04, 2025 3:43 pm

One in nine jobs in the Los Angeles area are tied directly or indirectly to the area's ports? I had no idea.

We still talk about tennis. And much more.

https://talkabouttennis2.com/

Short-term debt issued by corporations surged in April as companies sought to bolster their liquidity in the wake of economic uncertainty wrought by the Trump Administration’s tariff policies, according to strategists at JPMorgan Chase & Co.

Issuance of non-financial commercial paper swelled by $100 billion last month, which is above the monthly average of $27 billion seen from 2019 to 2024, excluding 2020, JPMorgan strategists led by Teresa Ho wrote in a note to clients on Friday, citing data from the Depository Trust & Clearing Corporation. At its peak, the gap between the highest-rated paper — known as Tier 1 — and T-bills stood at the widest level since August 2022. The spread to less credit-worthy paper — known as Tier 2 — reached its widest level since June 2023.

“Anecdotally, it appears companies are raising cash as a precautionary measure in response to the heightened uncertainty following Liberation Day,” they wrote.

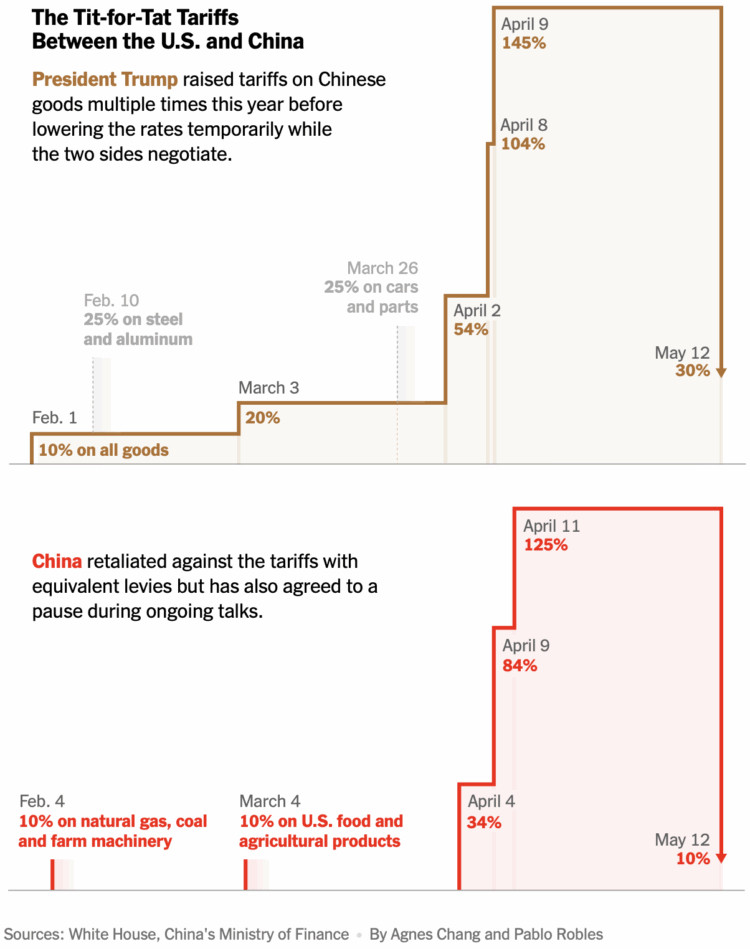

The Trump Administration’s tariff announcement on April 2 unleashed turmoil in the financial markets, with the S&P 500 losing more than 10% in two sessions. The benchmark index reversed course a week later, when the White House delayed most of the duties for 90 days, with the exception of tariffs on China. The uncertainty also caused Treasury yields to soar and sparked a rush for cash.

Corporations are bolstering cash positions due to economic uncertainty spearheaded by Tariffs.

Source: https://finance.yahoo.com/news/companie ... 04436.html

President Xi Jinping will use his state visit to Moscow this week to showcase his tight ties with Russian counterpart Vladimir Putin, and capitalize on a trade war that’s isolating Washington.

“Key on the agenda is what kind of opportunities there are, and how to coordinate Russia’s and Chinese actions to use these four years to undo the US hegemony,” said Alexander Gabuev, director of the Carnegie Russia Eurasia Center. The two men will want to “help Trump to destroy American supremacy and arrive at a multipolar world order where Russia and China can thrive.”

Source: https://finance.yahoo.com/news/xi-heads ... 12489.html

Going live with my meta glasses

@mustache-era.bsky.social

Follow

As they can customize headlines about the “dealmaking” process, the Chinese now have full control of the US stock market. As if they needed more leverage points.

Kimbell’s Mowgli @kimbellsmowgli.bsky.social

· 37m

And Japan has the bond market. Great job Donald.

With Trump back in office imposing blanket tariffs on all U.S. trading partners, global trade is seizing up fast. Instead of boosting American industry, these tariffs act like a tax hike on consumers and businesses, while retaliation from abroad crushes U.S. exports. Don’t believe me? Look up the total net goods The US imported in Q1 and then watch what that number is in Q2… if it’s anything like the collapse of imports from China that has been steadily dropping since end of April…

Meanwhile, a 2020 style oil shock where crude prices collapse into negative territory again due to oversupply and a global demand slump is also on the cards and will decimate the energy sector. Normally cheap oil helps, but not when it bankrupts U.S. shale, kills transport jobs, and signals a collapse in real economic activity.

The Fed is cornered. Inflation metrics fall, but only because energy prices crash… not because the economy is healthy. With rising unemployment (although not rising fast enough for Fed to act in it due to Baby Boomers and Gen X retiring en masse), weak demand, and a dislocated bond market, Powell’s hands are tied. If the U.S. receives a major credit downgrade (as seems likely with exploding deficits and falling Treasury demand), long-term yields could spike even as the Fed tries to cut. Eventually, the Fed will be forced into permanent QE and yield curve control… monetizing debt just to keep the system functioning. By then, inflation returns, not from overheating, but from a collapsing dollar and evaporating trust.

This is stagflation with a geopolitical twist. China, quietly in a recession of its own, will lash out economically or militarily. BRICS nations push harder for de-dollarization. U.S. allies may begin hedging away from Washington. The result? Gold over $3,000, the S&P down 50%, real GDP down 6-8%, and a long period of structural decline… where monetary policy dies, foreign capital flees, and the dollar loses its unipolar dominance.

The Fed isn’t behind the curve… they’ve lost the playbook. And the world knows it.

P1/2