Trump announces 10 percent tariffs on all imports, additional taxes for some 60 countries

The nation could see average import taxes reach 1930s levels.

Updated

April 2, 2025 at 4:44 p.m. EDT today at 4:44 p.m. EDT

The announcement is the culmination of weeks of internal discussions among senior Trump officials, who have tried resolving numerous conflicting purposes of the president’s tariff agenda.

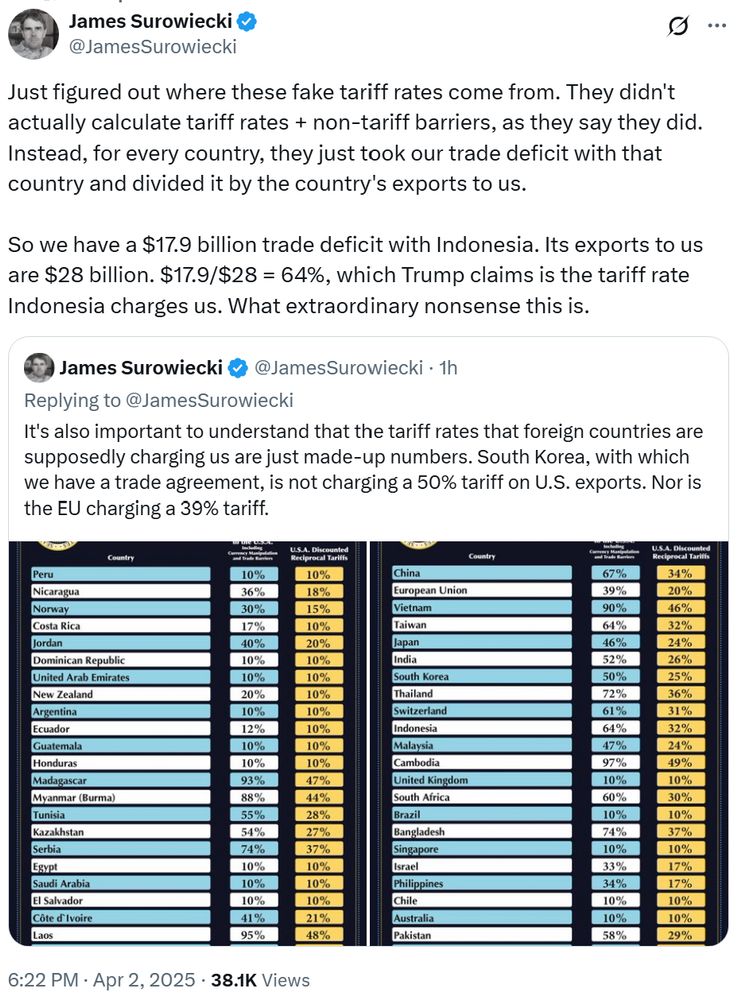

Initially, Treasury Secretary Scott Bessent pitched the April 2 announcement as creating “reciprocal” tariffs, in which countries could negotiate to have their duties lowered in deals with the White House. But last week, Trump asked advisers why the administration could not impose a simple single flat tariff rate on all countries, perhaps as high as 20 percent, The Washington Post previously reported.

Having one flat tariff rate was also meant to provide an incentive for companies to invest in the United States that would not be later rescinded as part of a deal, an idea Trump had run on during his 2024 presidential campaign. Through this week, Trump officials sought to reconcile their push for a “reciprocal” tariff agenda with the president’s desire for a universal tariff, which could bring in hundreds of billions of revenue to federal coffers.

Meetings late Tuesday involved Bessent, Commerce Secretary Howard Lutnick, Chief of Staff Susie Wiles and senior advisers Peter Navarro and Stephen Miller, according to two people familiar with the matter, who spoke on the condition of anonymity to reflect private deliberations. White House aides had grown concerned about the potential stock market reaction, said Wilbur Ross, who served as commerce secretary during Trump’s first term. That may explain why the administration did not pursue a 20 percent rate.

“There are some people who want it to be one rate for everywhere, on everything. Others want it everywhere, but by product. And others want it by product and by country. So there’s different ways of trying to accomplish it,” Ross said Wednesday before the official tariff announcement. “They’ve been scurrying around a lot at the last minute.”

In recent days, the administration dismissed increasing concern among investors, economists and some members of the Republican Party about the course Trump has chosen.

“They’re not going to be wrong. It is going to work. And the president has a brilliant team of advisers who have been studying these issues for decades,” White House press secretary Karoline Leavitt told reporters.

Americans are not convinced. In a CBS News-YouGov poll released Monday, 56 percent of adults surveyed opposed new taxes on foreign goods while 44 percent approved of them; 72 percent said they expected that tariffs would mean higher prices in the short term.

The president’s allies, meanwhile, see his economic overhaul in historic terms.

Trump’s goal is to “create an environment where we’re back to where we were before World War I,” said Newt Gingrich, former GOP House speaker. Trump believes the late 19th century was when “we were the strongest economy in the world, largely built around a high tariff, high wage, high manufacturing economy," Gingrich said.

“The current moment represents the “fifth great change in American history,” after the presidencies of Thomas Jefferson, Andrew Jackson, Abraham Lincoln and Franklin Delano Roosevelt, Gingrich said.

“There’s going to be turmoil; that’s a fact,” he said.

On Tuesday, meanwhile, a gauge of manufacturing activity showed erosion in the nation’s factory sector. The Institute for Supply Management’s closely watched monthly manufacturing index fell from 50.3 in February to 49 in March.

Companies responding to the survey said they were reducing their workforce through layoffs, attrition and hiring freezes, he added.

Los Angeles-based Xos is worried about potential new tariffs that could add $5,000 to $20,000 to the cost of components for the electric commercial vehicles it produces for customers such as FedEx. The company buys battery packs from China, electronics from Europe and motors and inverters from India and China, according to its filings with the Securities and Exchange Commission.

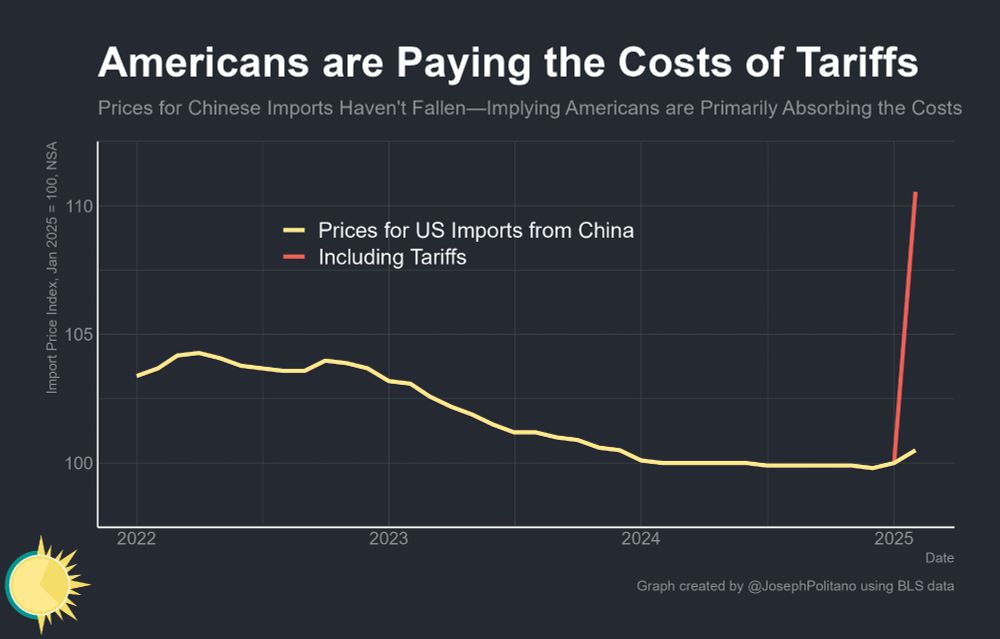

In little more than 10 weeks, Trump has imposed new import taxes on steel, aluminum, Chinese goods and some products from Canada and Mexico. Taken together, the tariffs already have lifted the nation’s average tariff from around 2.2 percent to about 8 percent, the highest figure in decades.

Depending on the specifics of Trump’s action Wednesday, the United States could soon have tariffs rivaling those enacted by the Tariff Act of 1930, also known as the Smoot-Hawley legislation, which most economists say made the Great Depression worse, according to Neil Shearing, chief economist for Capital Economics in London.

Relative to the size of the U.S. economy, trade is about five times as important as it was at that time, according to data from the Federal Reserve Bank of St. Louis and the World Bank.

“The world’s more trade-intensive now. The costs of trade friction are greater,” Shearing said.

On Wall Street, the S&P 500 index has lost 8 percent of its value since mid-February, when the president’s trade offensive intensified. Numerous companies have warned investors that Trump’s tariffs are costing them.

Babcock & Wilcox Enterprises in Akron, Ohio, for example, is seeing tariff bills of $10,000 to $7 million on the equipment it imports for energy and environmental projects, CEO Kenneth Young told investors Monday. The company is in discussions with its customers about how to handle the charges, which are unpredictable given the pace of administration policymaking.

“It changes daily, so who knows?” Young said. “And hopefully, some of these tariffs get removed or get reversed and business goes back to normal. But it’s just a little too early to know.”

https://www.washingtonpost.com/business ... day-trade/